Mixed Up? Here’s What to Do When Your Business Has Both Vatable and Exempt Income

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Why does “exempt” really mean “no VAT, but possibly trouble”? Whether your firm offers exempt or vatable supplies, or both, your VAT strategy and compliance may hinge on one thing: how you claim input VAT. Get it wrong, and SARS, and the courts, will notice.

The Difference Between Exempt and Vatable Supplies

Vatable supplies

These are goods/services that attract VAT at 15%. Businesses must register for VAT once they exceed the threshold (currently R1 million per annum in South Africa). Input VAT incurred on costs related to output‑taxable supplies may be reclaimed.

Exempt supplies

Certain supplies, typically financial services like providing credit or exchanging currency, are VAT-exempt. No VAT is charged (output tax = R0), and input VAT on costs related to these supplies generally cannot be reclaimed.

For Example

A medical clinic charging consultation fees: vatable (VAT applies, and they can claim input VAT).

A bank offering pure loan interest or simple currency exchange: exempt (no VAT charged, and input VAT cannot be reclaimed).

How does the type a supply influence the VAT registration?

Even if your business earns more than R1 million from exempt supplies, you only need to register for VAT if you also earn income from vatable supplies. But keep in mind, you can’t claim back VAT on expenses that are used only for your exempt activities.

📌Example: Sipho’s Tax & Loans Co. (Pty) Ltd

Sipho runs a small firm offering two distinct services:

Short-term loans to clients — this generates interest income, which is exempt from VAT.

Tax advisory services — billed at an hourly rate, this is a vatable service (subject to 15% VAT).

In the past year:

His loan interest income totaled R1.5 million (exempt supply).

His tax advisory services brought in R75,000 (vatable supply).

Most of Sipho’s income comes from exempt supplies, like interest on loans. But since he also earns over R50,000 a year from vatable services, he can choose to register for VAT. However, he’s only required to register if his vatable income alone goes over R1 million in a 12-month period.

Here’s the catch:

Sipho can’t claim input VAT on any business expenses directly related to the loan side of his operation. For instance, marketing for loan products or interest-related admin costs are non-deductible.

However, expenses tied to his tax services, such as software subscriptions, tax training, or client meeting costs, can qualify for input VAT deductions, but only in proportion to his vatable turnover. Mixed-use items (like rent or office supplies) must be apportioned correctly to avoid overclaiming.

If Sipho only offered loans, even exceeding R1 million in interest income, he would not have to register for VAT, because exempt supplies alone do not trigger mandatory registration.

Mixed Supplies and Apportionment

Many businesses, like financial institutions, offer a mix of exempt (e.g., interest) and vatable (e.g., fees) supplies. In these cases, SARS allows input VAT recovery, but only in proportion to the taxable portion. This leads to the principle of apportionment.

Under section 17(1) of the VAT Act, if input VAT relates to both taxable and exempt activities, a vendor must apportion VAT according to a SARS-approved method (via binding ruling) rather than reclaim the full amount.

Turnover-based method (standard approach)

This method looks at your total income from taxable vs exempt supplies and uses those percentages to calculate how much input VAT you can claim. It’s simple and quick, but it assumes all your services have similar profit margins and use the same amount of resources, which often isn’t the case.

Transaction-based method

Instead of looking at income, this method counts the number of transactions linked to taxable vs exempt supplies. It’s more detailed and takes longer to calculate, but it can give a fairer reflection of how your business really operates, especially if your services vary a lot in value or cost structure.

African Bank vs SARS, A Game-Changing VAT Ruling

African Bank, which charges both fees (vatable) and offers credit (exempt), applied a transaction-based apportionment. SARS wanted a turnover-based approach. It wasn’t just a preference, it changed the VAT they could claim.

Background

The African Bank requested approval for a transaction-based apportionment method via a binding ruling, under section 17(1)/41B. SARS denied that specific method and imposed a turnover-based method instead. African Bank objected. SARS dismissed it, claiming it hadn't "refused" the requested method, just offered an alternative.

What the Courts Decided

The Supreme Court of Appeal (SCA) sided with African Bank: SARS’s act of imposing an unrequested method was effectively a refusal of the requested one. That refusal is appealable under section 32(1)(a)(iv). As a result, the Tax Court had jurisdiction to hear the appeal.

Why It Matters

The court ruling made the following clear:

Vendors can object and appeal when SARS forces a method they didn’t ask for.

You don’t have to accept a "one size fits all" turnover method if it's unfair to your model.

It strengthens vendors’ rights, promotes fairness, and avoids unnecessary litigation.

Further Case Studies

Case 2: VAT 1626 – Direct Attribution vs. Apportionment

ABC (Pty) Ltd tried to claim full input VAT via direct attribution, arguing it could assign expenses fully to taxable vs exempt activities. SARS insisted on general apportionment. The Tax Court agreed with SARS, direct attribution was invalid for mixed-use items.

Case 3: Capitec v SARS (Constitutional Court, 2024)

Capitec sought to claim input VAT deduction on insurance that it provided free of charge. SARS refused to allow this, quoting that the supplies are free of charge, therefore qualify as exempt. The Constitutional Court ruled that even though the insurance was free, it had value because it made Capitec’s loan offering more attractive. Since Capitec earned both exempt income (interest) and taxable income (fees), the loan cover was a mixed supply. Apportionment of the input VAT was required SARS must work with Capitec to determine a fair apportionment method.

In Summary: What You Need to Know (and Do)

Only vatable supplies allow input VAT recovery. If you supply exempt services, you don’t charge VAT and you can’t claim back the VAT on related expenses. Managing this correctly is essential for staying compliant.

If you supply both exempt and vatable services, you must register for VAT if your taxable turnover from vatable services exceeds R1,000,000. The amount of input VAT you can claim depends on how you apportion expenses between exempt and taxable income.

Apportionment is mandatory under section 17(1) of the VAT Act for vendors making both taxable and exempt supplies. You can only claim input VAT on goods or services that relate to taxable supplies. If a particular expense is used 90% or more for taxable purposes, then it’s treated as fully taxable and 100% of the input VAT may be claimed.

The standard apportionment method uses a formula that compares taxable supplies to total turnover. This method applies only to mixed-use expenses — it excludes capital goods and non-supply income — and must be applied consistently and reviewed every year.

If this method produces an unfair result, you can apply for an alternative method that better reflects your business model. Common alternative bases include floor space, headcount, or actual usage. However, direct input VAT linked exclusively to taxable or exempt supplies should be claimed or excluded accordingly.

The apportionment formula only applies to shared or general overhead costs, not to costs that can be clearly assigned. Vendors are also expected to keep proper records of how the method was calculated, applied, and updated. This is essential if SARS ever audits your VAT claims.

Remember, incorrect apportionment, or applying the wrong method, can result in SARS disallowing your VAT claims or even issuing penalties. Review your apportionment ratio annually or whenever your business model changes significantly.

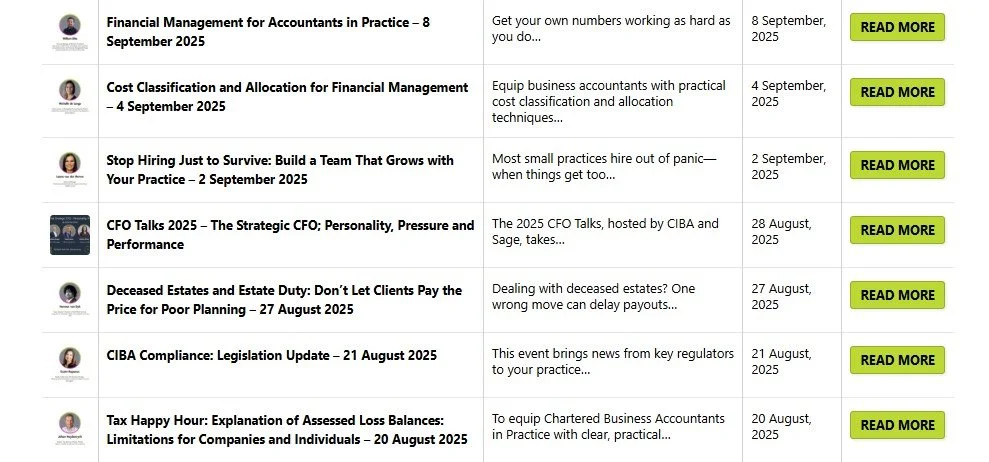

📺 Learn more about VAT and other tax related topics by enrolling for CIBA’s expert-led webinars!

Check out the CIBA webinars available on our Events Calendar!