A Taxman’s Casebook - Donations vs Valid Business Expenditures

When Is a “Donation” Not a Donation?

Your client contributes money to an ESD trust to support small businesses and improve their BEE score. Or donates stock to a children’s home. It looks generous. It feels compliant. But get the intent wrong, and you could trigger donations tax, VAT adjustments, or income tax recoupments.

In this practical case-based article, we look at the tax treatment behind BEE-linked funding, trading stock donations, and interest-free loans, and show you how to structure them properly before SARS asks questions.

When a Public Benefit Organisation (PBO) Is Taxed — and When It’s Not

Non-profit organisations often believe their receipts are automatically tax-free, until SARS proves otherwise. This article explains when a Public Benefit Organisation (PBO) truly qualifies for tax exemption, when tax applies, and how everyday activities like charging fees or earning trading income can create unexpected tax risk. Using practical SARS examples, it breaks down cost recovery, permissible trading, and the basic exemption in a way that helps accountants keep PBOs compliant and avoid costly surprises.

VDP Isn’t a Get-Out-of-Jail Card Unless You Get it Right

Mistakes happen and SARS doesn’t wait for explanations. If you client has undeclared income, foreign funds, or payroll slip-ups, the VDP offers a rare chance to fix past tax errors legally and avoid penalties or prosecution. This article walks you through the process, pitfalls, and powerful protections that come with getting it right.

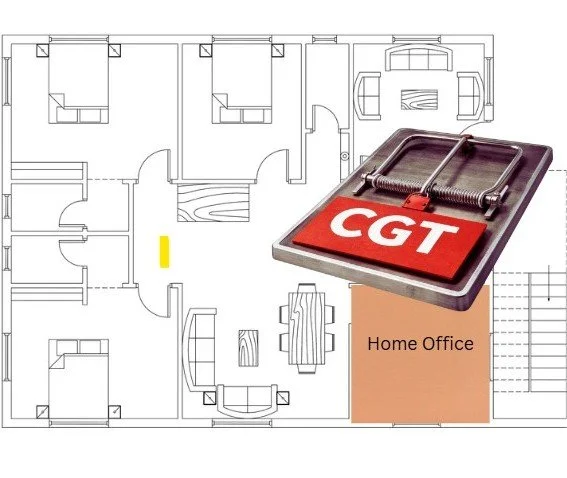

Home Office Deductions: The CGT Consequences Many Taxpayers Miss

Claiming a home office deduction feels like free money, a small win against rising costs and long work-from-home days. But that quiet tax saving can leave a long shadow. Years later, when a client sells their home expecting a CGT-free windfall, SARS may come knocking with an unexpected bill. This article exposes the hidden CGT tripwire in home office claims, and shows exactly when that “harmless” deduction turns into a costly mistake.

Zero-Rating, Real Rewards: How Exports Can Cut Your VAT Bill

Unsure how to handle zero-rated VAT when exporting?You’re not alone. Many business owners miss out on VAT savings simply because they don’t know the rules, or how to prove them. If you’re supplying goods or services to clients overseas, and they’re used outside South Africa, you could be charging 0% VAT. This article walks you through what qualifies, what SARS expects, and how to get it right every time.

South Africa Needs a Parliament of Taxpayers, Not a Parliament of Administrators

We’ve forgotten a powerful truth: in South Africa, only Parliament, not Treasury, not SARS, has the constitutional authority to impose taxes. Yet our representatives are playing catch-up while the state calls the fiscal shots. In this article we look at how taxation has drifted from democratic choice to bureaucratic default, and why it’s time to restore taxpayers as sovereigns, not subjects.

Guide on “Similar Finance Charges” Under Section 24J

Not all finance charges qualify for tax deductions under Section 24J. In the new interpretation note 142 SARS explains what counts as “similar finance charges” and what doesn’t, helping taxpayers and practitioners avoid incorrect claims. If you work with clients who borrow or lend as part of their business, this guidance is essential reading.

Residence Based Taxation - The Real Cost of Being 'Resident' in SA

Think earning money abroad means you’re off SARS’s radar? Think again. South Africa’s residence-based tax system means where you live matters more than where your income comes from. Whether you're freelancing from Cape Town or owning property in London, SARS wants its slice. This article explains how residency rules, double tax agreements, and foreign income exemptions really work, and what happens if you don’t play by the rules.

Taxing the Farm: What Every Accountant Needs to Know

Think farming tax is just about tractors and sheep? Think again. From claiming for packhouses to dodging VAT traps, there’s a lot accountants need to know to help farmers stay on the right side of SARS, and save money while they’re at it. This quick guide breaks down the key tax rules (with real examples) so you can spot the wins, avoid the penalties, and give smart advice that actually matters.

How to Clean Up Tax Messes - Your Guide to VDP

Got tax skeletons in the closet? SARS is looking, but there’s a way out. The Voluntary Disclosure Programme (VDP) lets taxpayers fix past mistakes before the penalties, or prosecutors come knocking. Whether it’s undeclared income, PAYE errors, or missed VAT returns, this guide shows you when VDP applies, how it works, and why acting early could save you a fortune.

VAT Reconciliation Doesn’t Have to Hurt (But Ignoring It Will)

Not doing VAT reconciliation? You might be making expensive mistakes.

Many accountants file their VAT returns and move on, but if your numbers don’t match your books, you could be heading for trouble. This article breaks down what VAT reconciliation really means, how to spot costly mistakes, and how to fix them. Use the CIBA template to ensure if SARS comes knocking, your records will hold up.

The Hidden Cost of SARS Verifications

Every year, millions of South Africans file their tax returns… and then get stopped dead by a SARS “verification”. In theory, this should be a quick check. In reality, it’s become a mini-audit asking for bank statements, medical aid proof, rental invoices, even electricity bills. How much time is wasted annually by ±2 million taxpayers collecting evidence, writing explanations, or paying a practitioner to do it?

The SARS Dispute Process: A Professional's Guide to Getting it Right

If SARS has hit you or your client with a penalty or unexpected assessment, don’t panic, and definitely don’t ignore it. There’s a clear, step-by-step process to challenge these decisions, from requesting a remission or asking for reasons, all the way to formal objections and appeals. This article looks at the steps, practical tips and timelines to help you respond confidently, avoid common errors, and potentially recover thousands.

Social Media Influencers and Tax: What You Need to Know (and Do)

If you're earning through brand deals, free products, or crypto as an influencer, there's one thing you can't ignore - tax. This article explains exactly what counts as taxable income, how to stay compliant, and what deductions you might be missing out on, because even your freebies aren't free from tax.

The Tax Gatekeepers: Public Officers, Registered Representatives and Tax Practitioners

Who's Really in Charge of Your Tax Profile?

If you think your tax practitioner is handling everything, think again. When SARS comes knocking, it’s the public officer or registered representative who takes the heat, not the external tax pro. In this article we look at the high-stakes roles every company must fill (and often gets wrong).

Home Office Tax Claims: What SARS Allows (And What It Doesn’t)

Think your dining table counts as a home office? SARS disagrees.

If you're working from home and hoping to claim tax deductions, you'd better know the rules. SARS's Interpretation Note 28 lays out exactly who qualifies, what counts as a home office, which expenses are allowed and what could land your claim in hot water. Read below and learn when and how to claim home office expenses and SARS scrutiny.

Medical Expenses in 2025: What You Can and Can’t Deduct

Need to claim medical expenses? This is for you.

With healthcare costs climbing faster than medical aid cover, understanding how to claim every cent of medical tax relief has never been more important. This article guides you on what medical expenses you can and can’t deduct in 2025, explains the difference between deductions and rebates, and shows how SARS’s medical tax credits can significantly reduce your tax bill. Read below and help your clients keep more money in their pockets while staying compliant.

SARS Expedited Tax-Debt Compromise Process: A One-Time Chance to Settle Tax Debt

Owing SARS money can feel like a never-ending burden, interest piles up, penalties grow, and enforcement looms. But for a limited time, taxpayers have a chance to hit reset. Through the SARS’s Expedited Tax-Debt Compromise Process, qualifying taxpayers may be able to settle their debt for less than the full amount, clear their tax record, and move forward with peace of mind.

5 Key Comments From CIBA on the 2025 Tax Amendment Bill

Big tax changes are on the horizon, and they could hit schools, side hustles, and retirees the hardest. CIBA has stepped in to raise concerns about the real-world impact of these proposals, warning that they could drive up school fees, punish entrepreneurs, schools, and retirees. What is CIBA’s goal? Keep tax fair, simple, and supportive of the people who keep the economy moving.

SARS Disputes Explained: From Objection to Court

Think SARS got it wrong? Here’s how to fight back legally and effectively. This article walks you through the full SARS dispute resolution process, from filing objections and appeals to navigating ADR, the Tax Board, and Tax Court. It's tailored for professionals who need to protect their clients (and their fees) when assessments go sideways.