FIC Compliance After Registration - What You Should Know

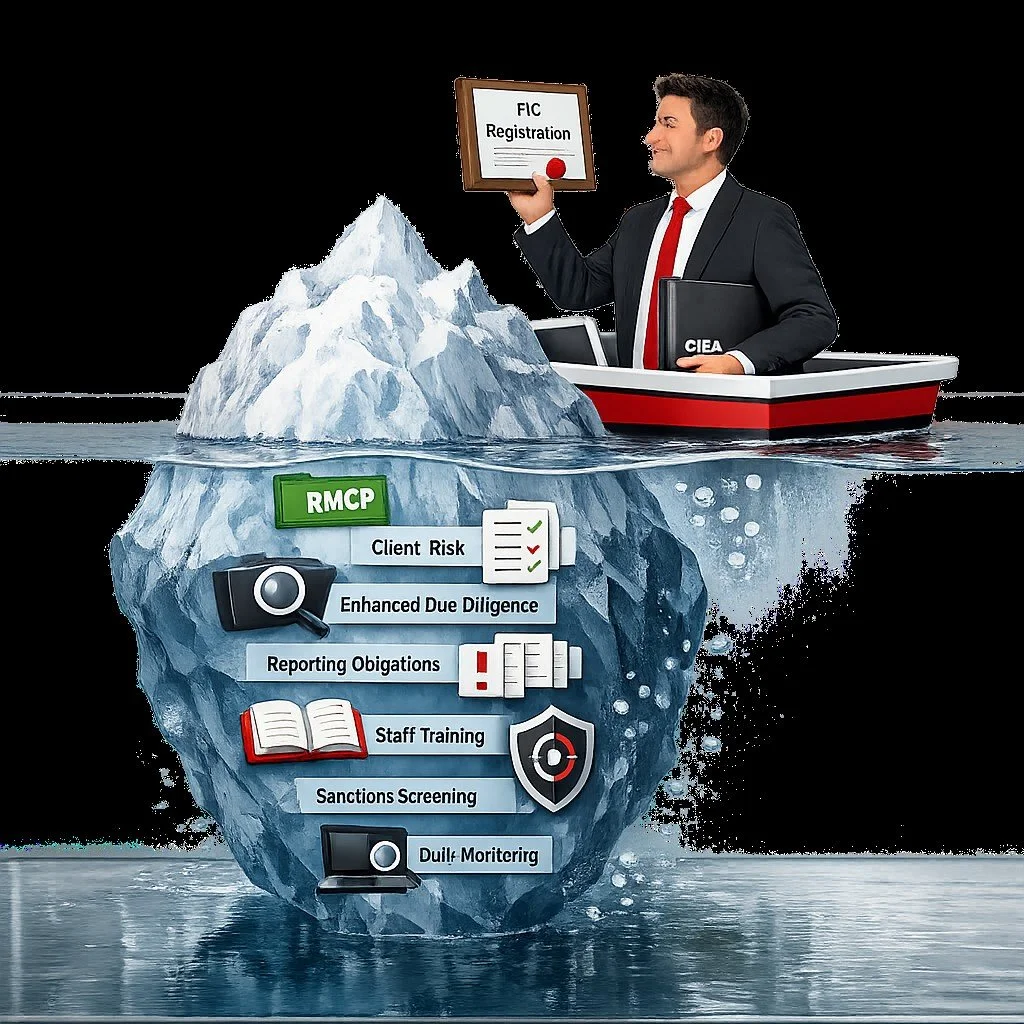

Registered with the FIC? That was the easy part. Now the real work begins. Too many firms think compliance is a once-off admin task, until an audit proves otherwise. FIC registration turns your practice into a permanently accountable institution, where every client, every transaction, and every employee decision carries regulatory risk. Here’s what every accountable institution needs to get right before the regulator comes knocking.

NCR 67(2) – They Closed the Door. We’re Opening It For You.

You did everything right. You qualified, complied, built a practice, earned client trust. Then a regulation told you no, not because you lack skill, but because the list was already full.

That moment triggers something familiar: defensiveness, frustration, disbelief. Not logic, instinct. The same instinct that freezes systems in time, protects incumbents, and treats new capability as a threat rather than a resource.

This article explores why Regulation 67 draws its line where it does, how that line affects real practices and real income, and why the tension you feel isn’t personal, it’s structural.

If you’ve ever been blocked by a rule that couldn’t justify itself, you’ll recognise this story immediately.

How Not to Get Prosecuted (or Sued)

Most accountants don’t lose their practices because they’re incompetent. They lose them because they’re casual. Casual with scope. Casual with authority. Casual with documentation. And the law doesn’t forgive casual.

If you think “I’ve known this client for years” is protection, you’re already exposed. If your engagement letter hasn’t been touched since onboarding, you’re gambling. If half your advice lives in WhatsApps, voice notes, or favours you didn’t bill for, you’re not unlucky, you’re predictable.

This isn’t a comfort piece. It’s a mirror. And it might explain exactly how good accountants quietly lose everything.

When Culture Speaks Louder Than Strategy

Corporate culture is often dismissed as a “soft issue,” yet it quietly shapes decision-making, risk behaviour, and long-term performance. From small businesses to large corporates, culture influences how people act under pressure long before the numbers reflect it.

Still Ticking Boxes While the Profession Passes You By?

Most accountants do not fall behind because they are bad at their job. They fall behind because they treat CPD as a box to tick instead of a strategy to stay relevant. The profession does not wait. If your knowledge is outdated, clients feel it, employers notice it, and your confidence slowly fades. This article explains why CPD is not admin, why ignoring it costs you more than you think, and why CIBA CPD is designed to keep you sharp, trusted, and in demand.

Make Meeting Compliance Deadlines Your New Year’s Resolution

Compliance is easy to ignore when nothing is going wrong. Deadlines feel routine, forms look familiar, and “we’ll do it later” sounds harmless. Until a SARS letter arrives, a company is deregistered, an employee cannot claim benefits, or a data breach exposes client information. Missed compliance deadlines are not small admin errors. They trigger penalties, audits, reputational damage, and in some cases, the end of a practice. This article explains why compliance discipline is no longer optional, where accountants get caught out most often, and how making deadlines non-negotiable can protect your clients, your reputation, and your income.

Your Firm Isn’t Broken. January Is.

Every January, your rational brain knows this isn’t sustainable.

But your emotional brain (the one that fears losing clients, income, credibility) takes over and says: “Just survive. Push harder. Don’t rock the boat.”

So you say yes.

You absorb the chaos.

You work longer, sleep less, and tell yourself it’s temporary.

And for a few weeks, that emotional brain wins.

Until February arrives with exhaustion, mistakes, resentment and the quiet question you avoid every year:

Why does this keep happening if I’m supposedly a professional?

This article is for that moment.

Your LinkedIn Profile Is Already Speaking for You – Make Sure It Says the Right Things

Before a client calls you, before a recruiter emails you, and often before a referral decides to trust you, they look you up online. In most cases, LinkedIn is the first place they land. Your profile has become part of your professional reputation, whether you actively manage it or not. For accountants and business professionals, this matters deeply, because trust and credibility are at the core of what you do. A clear, professional LinkedIn presence is no longer about marketing yourself. It is about making sure your first digital impression reflects the standard of work and professionalism you already uphold.

“Delete at Your Own Risk”: The Year-End Records Mistake That Could Cost You Everything

Every December, accountants across South Africa make the same deadly mistake: we shred files we think are “old enough.” But in a world ruled by POPIA, SARS audits, seven-year rules and indefinite retention laws, one wrong destruction decision can cost you clients, credibility, up to R10 million, or even significant jail time based on the seriousness of the violation. The danger isn’t what you keep. It’s what you delete too soon. Before you touch a single box this year-end, read this. It might save your practice.

When You Go on Leave, Your Practice Doesn’t, Even in December

December feels like freedom… until SARS drops a letter, a client panics, or a “quick favour” lands in your WhatsApp while you’re trying to breathe. Every CBAP knows the truth we don’t say out loud: the moment you go on leave, the risk in your practice spikes. Deadlines don’t care that you’re exhausted. POPIA doesn’t pause. And one missed step can cost you credibility you’ve spent years fighting for. If you’re taking festive-season leave this year, read this first, it might save your practice, your reputation, and your hard-earned rest.

Helping Clients Keep Cash Flowing in December

December looks festive on the outside, but behind the tinsel many small businesses quietly fight for cash flow survival. Bonuses must be paid, customers disappear on holiday, and January’s bills wait impatiently in the wings. This article gives CBAPs the practical steps to guide clients through the chaos so they can close the year with confidence instead of cash flow panic.

The Art of the Follow-Up: Getting Stakeholders to Respond

Still waiting on that reply?

Whether it’s audit season or month-end madness, one thing slows us all down, unanswered requests. This practical guide shows how to master the art of the follow-up without sounding like a nag. From setting expectations to knowing when to pick up the phone, it’s everything it is all you need to get answers faster, and with less stress.

Phishing Scams And Fraud:Why Accounting Firms Are In The Crosshairs

Accounting firms aren’t falling for phishing because someone clicked carelessly, they’re being targeted because the job runs on constant pressure. Tight deadlines, broken portals, impatient clients, cash-flow stress, and month-end that never ends create the perfect opening for cybercriminals. Attackers don’t need advanced hacking tools, they simply wait for you to be tired, rushed, or juggling ten things at once. One “urgent instruction,” one “payment release,” one “SARS confirmation,” and the trap is set. Phishing succeeds not through incompetence, but through timing and criminals are exploiting the realities of accounting work with precision.

Certified Copies Aren’t Enough Anymore: What the New FIC Rules Really Mean for Your Practice

Certified copies won’t cut it anymore and neither will complacency. The FIC’s new rules have flipped client verification on its head, shifting the burden squarely onto accountants. One wrong call and it’s not your admin clerk who’s liable, it’s you. From a 66x spike in ID check costs to the death of tick-box KYC, this is the moment every small firm must decide: adapt or fall behind. The new FIC framework rewards judgment, not paperwork and it’s changing how we onboard, price, and protect our practices. Are you ready to prove you really know your client?

Making Numbers Talk: How to Get Non-Financial People to Actually Listen

Most people don’t think in ratios or IFRS terms; they think in plans, people, and paydays. This article shows how to turn financial data into clear, practical insights that clients and managers can understand and act on. By adding context, using plain language, and linking every number to a decision, accountants can move beyond reporting results to helping businesses grow and succeed.

When Power Becomes Risk: Why Every Accountant Must Understand PEPs

That new client who “knows people in government” might be your biggest compliance risk. Under South Africa’s anti-money-laundering laws, politically exposed persons (PEPs) (and even their families) trigger the toughest checks in the book. Miss one, and your firm could face FIC sanctions that make tax penalties look like pocket change. From cabinet cousins to state-contract CFOs, the line between influence and exposure is thinner than ever. Here’s what every accountant needs to know before saying yes to a powerful client and how to keep your practice off the regulator’s radar.

From Red Flags to Revenue: Mastering Advanced Risk Advisory

What if your next revenue stream isn’t a new client—but a red flag?

In this eye-opening second instalment of our Risk Management Series, we show you how to go beyond ticking boxes and start turning business risks into real advisory value. Learn how to score and rank risks, use COSO without the corporate fluff, and build registers that clients actually understand. Whether you’re helping them dodge compliance disasters or prepare for funding, this is how you shift from reactive accountant to trusted business strategist, and get paid for it.

Foreign Hires, Local Risks: The Compliance Rules You Can’t Afford to Miss

Foreign hires can grow your practice or expose it.

In South Africa’s post-greylist reality, hiring a foreign national isn’t just an HR step, it’s a financial crime compliance event. Every passport, visa, and background check you skip becomes a risk waiting to surface. Regulators are asking: Do you really know who’s on your payroll?

This practical guide breaks down how to protect your firm. From verification and recordkeeping to staff training and real-world risk control. Before you sign that next contract, make sure your compliance file is ready.

Relationships Drive Results

Strong client and stakeholder relationships are the hidden power behind every successful accounting practice. Relationships Drive Results shows how CBAPs can turn everyday interactions with clients, SARS, and even staff, into opportunities for trust, loyalty, and business growth. This isn’t theory; it’s a practical guide for accountants who want fewer conflicts, faster decisions, and a reputation that earns respect and repeat business.

CIBA’s Tax-Time Power Play: Turning SARS’s One-Off Compromise into Systemic Reform

While many see SARS’s expedited tax-debt compromise as a quick fix, CIBA sees a once-in-a-decade opportunity to transform how South Africa manages tax debt. Beyond settling liabilities, this initiative could empower practitioners, streamline processes, and rebuild trust between taxpayers and the revenue service. CIBA’s proposals envision a coordinated national framework, practical training, legal safeguards, and equitable procurement, turning a temporary relief measure into a sustainable system reboot. For accountants, advisers, and small firms, this isn’t just policy, it’s a chance to professionalise, protect, and profit from the very work that keeps the tax system running.