Segregation of Duties: Because Even Saints Need Supervision

In many small businesses, one trusted individual quietly becomes the centre of every financial process, approving payments, capturing transactions, reconciling bank accounts, and reviewing their own work. While this arrangement often grows out of necessity rather than intent, it concentrates risk in a way that is rarely visible until something goes wrong. Errors go undetected, pressure builds, and the absence of independent oversight undermines both governance and confidence in the numbers. What appears efficient on the surface can, over time, expose the business to financial loss, compliance failures, and reputational harm.

Fair Value and Farming — Turning Growth Into Numbers Without Guessing

IAS 41 leaves no room to avoid fair value measurement. When active markets exist, prices provide clear evidence, and when they do not, valuation models step in to reflect expected future cash flows. This approach forces accountants to recognise growth and risk before anything is sold, which can feel unsettling but reflects economic reality. Mastering fair value under IAS 41 is not just a technical exercise, it is essential for producing financial information that decision makers can trust.

Is It Farming or Just Animals? The Classification Trap in IAS 41

IAS 41 does not apply simply because something is alive. The key question is why the business holds the asset and whether it is managing biological transformation for profit. The same animal can fall under completely different standards depending on its purpose, and once agricultural activity is confirmed, correct classification becomes critical. Consumable assets, bearer assets, plants, animals, and harvested produce all follow different accounting paths, and a mistake at this stage distorts every number that follows.

When Your Assets Refuse to Sit Still

Agriculture does not fit neatly into traditional accounting models. Biological assets grow, reproduce, deteriorate, and change value even when nothing is bought or sold. Weather, disease, and time itself all affect value. IAS 41 exists because cost accounting cannot explain this reality. It recognises that when a business manages living assets for economic benefit, growth and risk are part of performance. The challenge is not whether the assets are alive, but whether the numbers tell the truth about what is really happening on the farm.

When Accruals Meet Acrylic Paint: Accounting for Creative Clients Without Losing Your Mind

Creative businesses do not struggle with compliance because they are careless, but because traditional accounting systems were never designed for how they work. Income is irregular, project-based, and often delayed, while accounting assumes predictable cycles and stable cash flow. When these assumptions collide, VAT becomes a surprise, provisional tax feels punitive, and penalties appear before understanding does. Many creatives are labelled as disorganised when the real issue is structural misalignment. They think in deadlines and deliverables, not tax periods and accruals. When accounting is adapted to reflect this reality, compliance improves, anxiety drops, and the accountant becomes a trusted advisor rather than the bearer of bad news.

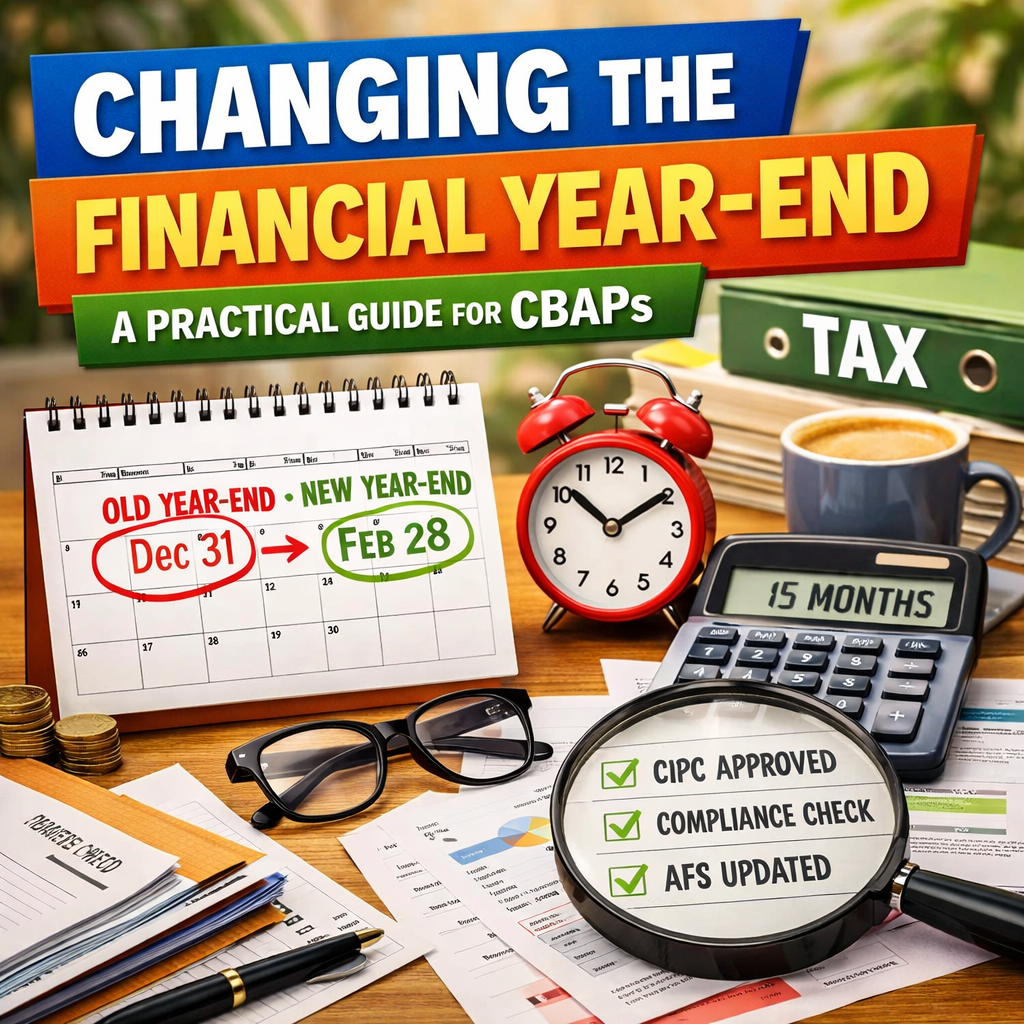

Changing a Company’s Financial Year-End: A Practical Reality Check for CBAP’s

Changing a company’s financial year-end may look like a simple date change, but in reality it is a regulated decision with compliance consequences. The year-end can be shortened, but it may never exceed 15 months, and the change only becomes valid once approved by CIPC. When this step is missed, financial statements, annual returns, and compliance timelines fall out of sync, often leading to penalties and unnecessary rework. For CBAPs, understanding not just what can change, but how and when, is essential to getting it right the first time.

Is This Really important? The Everyday Art of Materiality in Accounting

How do you know when something is a big deal, and when it’s just noise? Every accountant faces that call, especially during reviews, reporting, or when a questionable director loan lands on your desk. That’s where materiality comes in. It helps you cut through the clutter, spot what really matters, and avoid wasting time on things that don’t move the needle. In this article, we break materiality down in simple terms, what it is, when to use it, and how to calculate it without overthinking it.

Income Tax, Deferred Tax, and the Art of Not Panicking

Deferred tax doesn’t have to be intimidating. By focusing on timing rather than technical rules, this article explains how income tax and deferred tax work together under IFRS for SMEs — and why deferred tax is less about compliance and more about telling the full financial story.

As Auditors Sharpen Their Scrutiny of Fraud, Accountants Will Feel the Impact

Fraud is back in the spotlight and accountants need to pay attention. With new changes to the audit standard ISA 240, there’s now more focus on identifying and responding to fraud risks in financial reporting. What does this mean? There will be more questions from auditors, stricter checks on controls, and closer review of red flags like unusual transactions or poor cash flow. Do not be left behind, know what’s changed, what to look out for, and how to stay prepared.

B-BBEE Affidavits: Why CIBA Members Must Treat Them as Agreed-Upon Procedures Engagements

B-BBEE affidavits may look quick to complete, but they require more than filling in a form. When a practitioner helps a client with an affidavit, the work must be done as an Agreed-Upon Procedures (AUP) engagement. This means you check only the facts, perform the procedures agreed with the client, and then report exactly what you found. You do not give an opinion, you do not confirm compliance, and you do not provide assurance. You simply state the factual findings from the procedures performed. This protects you and gives the client a correct and defensible affidavit.

Revenue Recognition: Why So Many Get It Wrong

Many business owners still believe revenue is recognised when the customer orders, pays or collects. But accounting does not follow the cash or the excitement of a new order. It follows performance. Revenue is only recognised when you have delivered what you promised and the customer has gained control of it. This simple idea, performance before payment, is the key to getting revenue recognition right and avoiding the common mistakes that distort profits.

Stop Letting Dead Stock Sink Your Business

Every dusty item on a shelf is a silent cash-flow leak waiting to be exposed. Small businesses underestimate how much money is trapped in stock that no one wants to buy anymore. When accountants step in and help identify obsolete inventory, they free up working capital and protect clients from inflated closing stock and SARS problems. This is practical advisory work clients value immediately.

You Can’t Run a Business Without a Proper Chart of Accounts — How to get it right

A Chart of Accounts isn’t an admin checklist — it’s the financial engine that drives profit, compliance, and credibility. Get it wrong, and your reports become chaos. Get it right, and you gain instant control, cleaner audits, and sharper business insights. Here’s how smart accountants turn the COA into a strategic advantage.

No Panic, No Chaos: Helping Clients Become Audit-Ready the Simple Way

When audit season arrives, the tension often builds long before the auditors even walk through the door. The real problem is not the audit itself, but the lack of audit readiness. Missing documents, late reconciliations, and unclear explanations turn a simple process into a stressful one. This article explains how accountants can guide clients toward smoother, calmer and more efficient audits by building simple habits throughout the year. When clients stay organised and proactive, the audit stops feeling like a fight and becomes a powerful tool for trust, growth and better business decisions.

Income Received in Advance: When Money Arrives Before the Work Is Done

When money hits your bank account before you’ve done the work, it can feel like income, but accounting tells a different story. Income received in advance is a promise, not profit. Whether it’s prepaid rent, school fees, or a subscription, this money belongs on your balance sheet as a liability until you’ve earned it. Understanding this simple concept helps businesses stay honest, accurate, and financially sound.

Prepayments: The Hidden Story Behind “Pay Now, Benefit Later”

Prepayments may seem like small accounting entries, but they reveal a lot about how a business thinks about time and value. Paying upfront for future benefits is not just a cash flow decision — it’s a lesson in discipline, foresight, and financial honesty. For accountants in practice, explaining prepayments in plain language can turn a routine adjustment into a powerful conversation about planning, trust, and smarter business. After all, good accounting is not about the past; it’s about making tomorrow’s numbers make sense.

Break-even Made Easy

CVP analysis shows how costs, sales, and profit connect. It helps financial managers and advisors move from reporting numbers to guiding real decisions like pricing, growth, and risk planning. Simple, clear, and powerful, it turns everyday data into strategies that keep businesses profitable and future ready.

Independent Reviews: Asking the Right Questions

Independent reviews are not about ticking boxes or cutting corners. Under ISRE 2400, the true strength of a review lies in asking the right questions. Effective enquiry goes beyond “yes or no” answers , it digs into the story behind the numbers, uncovers risks, and opens doors to valuable insights. When practitioners master this skill, they not only protect themselves and their clients but also transform a statutory requirement into an opportunity to build trust, grow their practice, and strengthen South Africa’s business landscape.

From Numbers to Clues: How Analytical Procedures Crack the Case in Reviews

Analytical procedures are the secret weapon of independent reviews. They save you time, expose hidden risks, and open doors to valuable client conversations. Instead of drowning in invoices, you get to play detective, comparing periods, linking statements, and spotting anomalies that tell the real story behind the numbers. Done well, these procedures turn a compliance exercise into an opportunity to add value and position yourself as the trusted expert.

Planning an Independent Review: Setting the Foundation for Quality

Independent reviews are often underestimated, but the truth is they play a powerful role in building trust and credibility. The key to getting them right is not more checklists or endless procedures, but smart planning. ISRE 2400 (Revised) reminds us that a focused, well-documented plan is the foundation of quality. From setting materiality to identifying risk areas and designing targeted procedures, planning helps practitioners work smarter while protecting their practice. Done right, it turns an independent review into more than compliance , it becomes a valuable service that strengthens client confidence and showcases the professionalism of CIBA members.