NPO Money Mess? How to Take Control of Funding, Income and Expenses—Without Losing Donor Trust

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Running the books for a non-profit? Don’t let the “non-profit” label fool you—these entities need just as much financial oversight as any business. In fact, when you’re managing someone else’s donations, grants, or membership fees, the stakes might be even higher.

So what exactly is a non-profit organisation?

Let’s clear this up first. A non-profit organisation (NPO) exists to serve the public or its members, not to make profit for distribution. But that doesn’t mean it can’t make a surplus. It just means that surplus must be used to further the mission—not to line anyone’s pockets.

You’ll find NPOs everywhere: churches, sports clubs, charities, schools, and community groups. They might collect:

Membership fees

Donations and bequests

Government grants

Fundraising income

The Golden Rule: Every Rand Must Be Accounted For

Unlike a regular business, where profit is the goal, NPOs must prove that funds were used for the right purpose. This is where fund accounting comes in.

What is Fund Accounting?

It’s a way of keeping income and expenses separate based on their purpose. Think of each “fund” like a mini budget with its own rules.

Different Types of Funds You’ll Encounter

How Do You Keep Spending Under Control? Budgets.

Every fund should have its own budget, and only approved expenses should be made

Examples of Fund Handling

Not All Funding Is Equal — and That Matters for Your Books

NPOs don’t just get “money”—they get purpose-driven money.

Here are the most common types of income, and how to handle them:

1. Donations with Conditions (Restricted Funding)

Some donors give money and say exactly how it must be used: “Only for bursaries,” “Only interest income may be spent,” or “Buy a vehicle with this.”

✅ Accounting Tip: Use Fund Accounting

Set up a special fund in your general ledger to track this income separately. This ensures transparency and protects the capital.

🧾 Example: Van Wyk Bursary Fund

CIBA College received R150,000 for bursaries only.

Invested at 10% p.a.

Interest used: R27,000 (2023), R18,000 (2024)

Capital untouched

A separate ledger and income statement was kept just for this fund.

This approach keeps the donor’s conditions intact and makes audits a breeze.

2. Donations Without Conditions (Unrestricted Funding)

If there are no strings attached, treat the money as part of the general fund. This can cover salaries, rent, or any other operating cost.

Still show gratitude by noting large donations in your notes or disclosures—transparency builds trust.

3. Capital-to-be-Used Donations

Some donors want both capital and income to be used—but for a specific purpose.

🧾 Example: Building Fund

Dr. J Victor left R100,000 to CIBA College to be used (income only) for lab equipment.

Interest earned: R8,000 (2023), R12,200 (2024)

Used for equipment purchases

Capital remains untouched

Equipment was recorded as an asset, and transfers clearly shown from the Victor Fund to the general fund.

Membership Fees

A steady income stream for clubs and associations.

What to do:

Reverse prior-year income at year-end

Record current year as income

Record any advance payments as liabilities (deferred income)

🧾 Example:

2023 fees: R1,000

Advance for 2024: R40 → recorded as a liability

Arrears written off if unrecoverable

This ensures only the correct year’s income shows in your statements.

Can NPOs Make a Profit? Yes—but…

They can run profitable activities like tuck shops, car washes, or fundraising dinners. But be careful—income from trading activities can become taxable if it doesn’t fit SARS’s public benefit rules

Treat each project like a mini business:

Income

Cost of sales

Direct expenses

Profit (if any)

🧾 Coffee Shop Example:

Sales: R35,000

Opening stock: R12,000

Purchases: R25,000

Expenses: R2,500

Closing stock: R10,000

Net profit: R5,500

Be careful: SARS may tax trading income if it goes beyond your stated purpose.

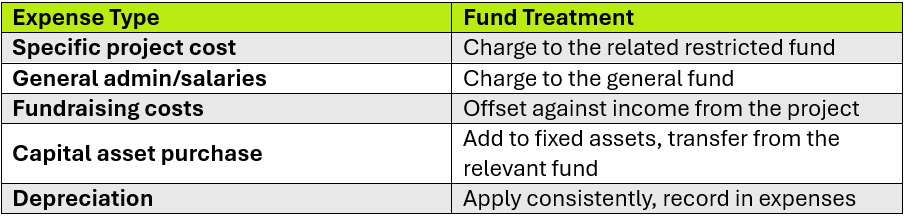

What About Expenses?

Match expenses to the source of funding wherever possible.

Top 5 Practical Tips for Accounting in NPOs

Track every cent separately—especially for donations with conditions.

Use clear fund names in your ledgers (e.g., “Cohen Bursary Fund”).

Prepare a mini income statement for each fundraising project.

Record membership fees accurately—split between current year, arrears, and advance.

Use plain, transparent reports for boards and donors—they want to see impact.

One Last Thing: Tax Still Applies

Most NPOs are exempt from income tax—if they’re registered as Public Benefit Organisations (PBOs) with SARS. But trade income might be taxed if it goes beyond the scope of your mission. Always check the exemption status and keep separate records for taxable activities.

Bottom Line: Transparent Accounting Builds Donor Trust—and Keeps SARS Off Your Back

Funding is the lifeblood of NPOs. But if you can’t show where it went, how it was used, and who it benefited, you risk losing the support you rely on.

Done right, proper accounting not only protects the organisation—it positions you as the financial expert NPOs can’t do without.

Want to attract more NPO clients? Start by helping them track their money properly—and stay funder-ready, always.

Join CIBA for a CPD on Taxation for NPO and PBO here.

By attending this webinar you will gain the following competencies

Distinction between NPO’s with and without PBO status.

PBO’s not being exempt from income tax but subject to partial system of taxation.

That special VAT rules applies for NPC’s, Welfare organizations that can provide valuable benefits for clients.

Choose Your Path to Exclusive Insights

Stay ahead in the world of accounting with premium content designed for professionals like you. Access expert articles, industry trends, and essential resources. Become a CIBA member and claim your CPD hours from CIBA.

CIBA Member Access

R250.00 FREE!

100% Discount when you become a CIBA Member. Join now to claim your CPD Hours. Register here: https://accounts.myciba.org/register