Accounts Receivable: The Hidden Lever That Builds Cashflow Confidence

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

If you’re offering credit to customers but not treating your accounts receivable (AR) as a strategic process, you’re leaving money on the table. The accounts receivable cycle isn’t just a finance function. It’s a system that either strengthens your cash flow or quietly sabotages it. When you understand it properly, you can reduce write-offs, collect faster, and make smarter decisions about which customers deserve your trust—and your terms.

From Sale to Settlement: Every Step Counts

The AR cycle kicks off the moment a sale is agreed. Goods are delivered, services are completed, and an invoice is issued. From there, you’re in the credit business. Whether or not you planned to be.

The payment doesn’t just arrive by magic. It takes tracking, follow-up, clear terms, accurate invoicing, and professional communication to get that money in the bank. Every skipped reminder, vague term, or misallocated receipt slows things down and increases your risk.

Everyone Plays a Part

This isn’t a solo job. Sales teams often overpromise or forget to enforce terms. Credit controllers carry the responsibility for vetting clients, setting limits, and chasing late payments. Bookkeepers handle the journals and reconciliations. Management sets policy and signs off on risky calls. Even the customer has a role in communicating and paying as promised.

When these roles don’t align, the cracks appear. A missed delivery note here. A vague payment reference there. Before long, you’re chasing balances you thought were settled and explaining variances in your cash flow.

Credit Terms Aren’t Fine Print

If your credit terms are buried in an invoice footer, don’t expect them to protect you. Terms need to be agreed upfront, included in your contracts, and reinforced at every interaction. They define your payment expectations, support your collection efforts, and protect you when a dispute arises.

Make sure your team knows how to explain them, and don’t be afraid to customise terms for high-risk clients. Shorter payment periods or upfront deposits can make a real difference. And if a client pushes back on your terms, it’s already a red flag.

Don’t Hand Out Credit Without a Gatekeeper

Vetting clients is not about being cautious for the sake of it. It’s about knowing who can and will pay you. A formal credit application, a review of their payment history, and a few reference checks can save you the pain of issuing invoices that never convert to cash.

Just because a client is large, friendly, or says all the right things doesn’t mean they’re low risk. Your vetting process must be consistent, documented, and separate from sales targets. Protect your practice before the deal is done.

Credit Limits Are Not Optional

Setting credit limits is one of the most effective ways to protect your business from exposure. They stop you from extending more credit than a customer can handle. They also create a clear boundary for internal approval processes.

Review credit limits regularly, especially if a client’s payment patterns change. Use your accounting system to flag breaches and lock further credit until the account is settled. And document every decision. That one habit alone can prevent finger-pointing when accounts go bad.

Invoicing Should Be Fast, Accurate, and Trackable

Slow invoicing delays cash. Inaccurate invoicing causes disputes. Poorly formatted invoices get ignored. Make your invoice clear, complete, and easy to process. Use consistent formats. Include all supporting documentation. Send it to the right person.

Most importantly, follow up to confirm it was received. Don't assume that the invoice sitting in your outbox is already in their system.

The Art of the Follow-Up

Effective follow-up is what separates firms that get paid on time from those that write off debts quietly. Start with a friendly reminder before the due date. Then escalate with polite but firm communications if payment is late.

Use templates, automation, and call logs. Keep your tone professional, but don’t let overdue accounts slide. If a customer ignores emails, makes repeated excuses, or breaks promises to pay, it’s time to escalate internally and, if needed, externally.

Reconciling and Allocating Payments

A payment received is not a payment completed unless it’s correctly allocated. Reconciliations should happen monthly at minimum, and ideally more often for high-volume accounts. Watch out for unallocated deposits, incorrect references, or mismatched amounts.

Automated systems help, but human judgement is still essential. Clear remittance advice, regular communication with the customer, and consistent checking of ledgers against bank records will keep your books clean and your follow-ups focused.

When Things Go South

No one likes to talk about bad debts, but pretending they don’t exist won’t save you. Review your receivables regularly and assess whether any amounts need to be impaired. If the customer is liquidated, in business rescue, or consistently unresponsive despite all efforts, it may be time to write the debt off.

Write-offs should follow a documented process with internal approval. They don’t mean you’ve failed. They mean you’re being honest with your numbers and protecting your credibility with lenders, investors, and auditors.

Internal Controls That Protect You

A solid AR process depends on having strong internal controls. Make sure no single person controls the entire cycle. Authorisation limits, system restrictions, and proper reconciliations are all critical.

Red flags include frequent credit notes, unmatched debtor balances, and a single staff member handling everything from credit approval to collections. Regular reviews, exception reports, and audit trails are your early warning system.

Use the Right Tools

Technology can’t fix a broken process, but it can make a good one more efficient. Use accounting software that integrates invoicing, allocation, and reporting. Set up automated reminders. Use dashboards to track KPIs like debtor days and collection ratios.

Don’t let the data sit idle. Use it to hold teams accountable and make informed credit decisions.

The Bigger Picture

Accounts receivable is not just about collecting what you’re owed. It’s about controlling your business narrative. It shows whether your systems are working, whether your customers respect your terms, and whether your team is aligned on what matters most: getting paid.

By owning your AR cycle end to end, you’re not just improving cash flow. You’re setting a standard for how your practice operates and showing clients that you understand the difference between growth and sustainable growth.

Join CIBA CPD here

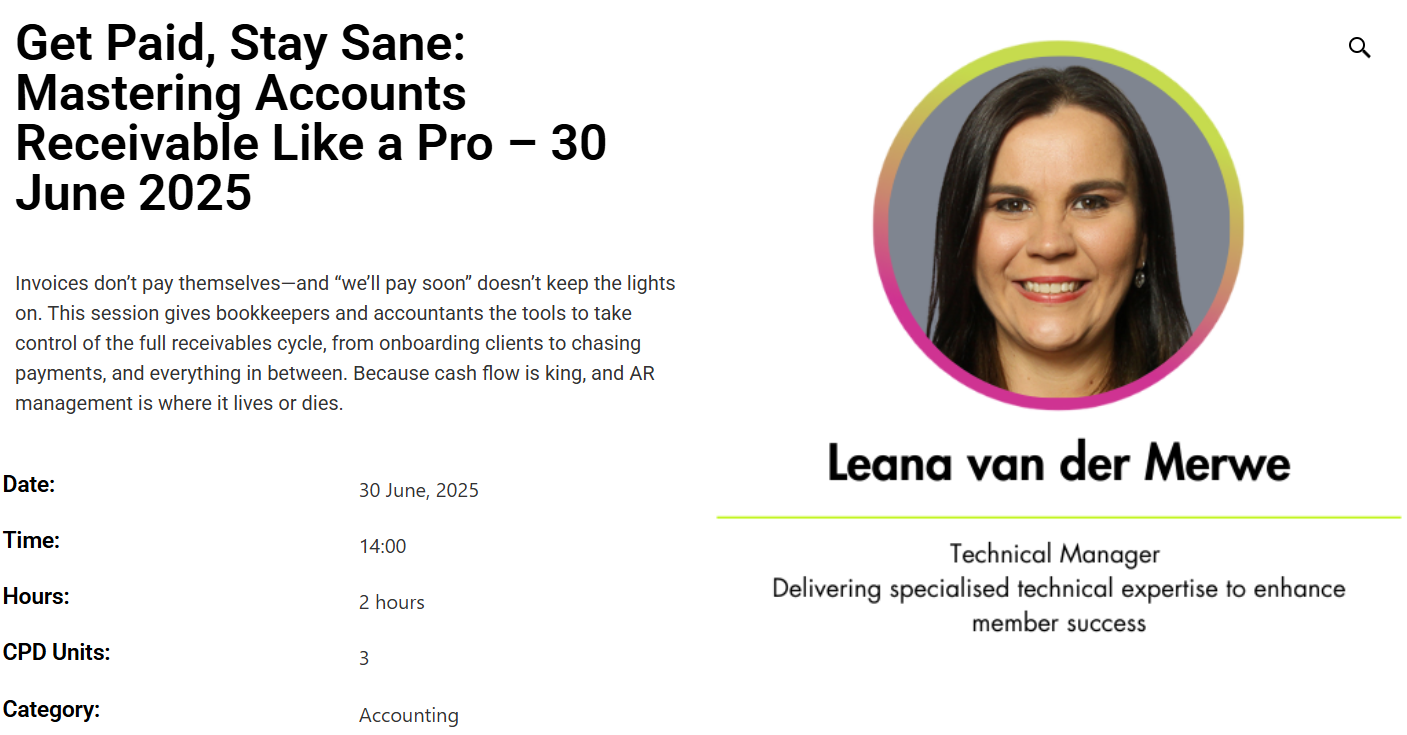

Get Paid, Stay Sane: Mastering Accounts Receivable Like a Pro

💼 Still chasing invoices like it's part of the job?

It doesn’t have to be that way.

Get Paid, Stay Sane: Mastering Accounts Receivable Like a Pro

🗓️ 30 June 2025 | 🕑 14:00–16:00 | 📚 3 CPD Units

If you’re tired of late payments, vague promises, and awkward follow-ups, this session will show you how to take full control of the accounts receivable cycle—from onboarding clients to collecting cash without the drama.

You’ll learn:

✅ How to vet clients upfront and avoid future bad debt

✅ The follow-up system that gets invoices paid on time

✅ How to build AR into your service offering (and get paid for it)

✅ What a solid age analysis and AR dashboard should really look like

Free for CIBA Channel 2 subscribers

R345 for everyone else

Because if your cash flow’s a mess, your business is next. Let’s fix that.

🔗 Register here

Choose Your Path to Exclusive Insights

Stay ahead in the world of accounting with premium content designed for professionals like you. Access expert articles, industry trends, and essential resources. Become a CIBA member and claim your CPD hours from CIBA.

CIBA Member Access

R250.00 FREE!

100% Discount when you become a CIBA Member. Join now to claim your CPD Hours. Register here: https://accounts.myciba.org/register