Master Estate Administration with Confidence, Fast and the Right Way

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

When someone dies, families often turn to their accountant. But estate administration is more than closing files, it’s about protecting legacies and doing things by the book. Get it right, and you become indispensable.

Here’s a clear, practical guide including deadlines, legal guardrails, and what you need to do, and who you're legally allowed to act for.

What are the Timelines?

South African estates follow a structured timeline under the Administration of Estates Act 66 of 1965 and its regulations. Here’s your roadmap:

Within 14 days after death you need to submit a death notice and the original will (if there is one) to the Master of the High Court.

Apply for Letters of Executorship immediately, so you can act legally.

Within 30 days of appointment, the executor must lodge the inventory and estate data with the Master.

Advertise for creditors, place notices in the Government Gazette and a local newspaper to allow 30 days for claims.

Open an estate bank account to collect assets and pay debts.

Within six months (unless the Master grants an extension) submit your Liquidation & Distribution (L&D) Account, with supporting vouchers.

Advertise the L&D Account for public inspection for 21 days before distribution.

When clear, distribute assets, then report to the Master and close the estate.

Who’s Legally Allowed to Administer Estates? Know the Limits

Here’s a legal trap many accountants don’t know: Regulation 910 strictly controls who may administer an estate.

Only the following can liquidate or distribute a deceased person’s estate:

Attorneys, notaries, and conveyancers

Law agents under the Magistrates’ Courts Act

Boards of executors and trust companies registered before October 27, 1967

"Public accountants" registered under the now-repealed 1951 Act.

Modern accountants, including CBAPs, generally don’t qualify under those exemptions, unless they were registered under that 1951 law.

Case law emphasizes substance over title. If you act like you’re administering, even “just helping the executor”, you may be breaking the law. However, exemptions may apply if:

You assist a lay executor (e.g., spouse or family up to 2nd degree), but only under direct instruction and not handling administration independently.

You work under the direction of a legally authorised executor or legal professional.

Executor Duties: What You Can Advise, and What You Must Leave to the Law

If you’re properly appointed and authorised to administer the estate, here’s what you can do:

Secure assets and liabilities.

Lodge the L&D Account, advertise creditors, and submit the estate bank account.

File tax returns and seek compliance letters from SARS.

But if you're not authorised under Regulation 910, your role must be scoped to:

Provide tax and accounting advice only, under the executor’s instruction.

Refer estate administration work to an attorney or qualified fiduciary.

Support, but don’t perform liquidation or distribution tasks.

Tax Musts, Timelines and Duties

Death doesn’t pause SARS. As a tax practitioner, you must file the final income tax returns for the deceased and the estate via the estate bank account.

Get the Deceased Estate Compliance (DEC) Letter. You need this before distributing assets.

If the estate exceeds R3.5 million, estate duty applies:

20% on the first R30 million,

25% on the remainder.

Failing to secure clear tax status can leave the executor personally liable, so don’t skip it. Use SARS’s timelines carefully and file promptly.

5. Why Doing This Right Makes a Difference

Knowing real timelines and legal boundaries isn’t just about compliance—it’s competitive advantage.

Families trust you with sensitivity and accuracy.

You safeguard their assets from delays, disputes, or penalties.

Your practice grows, offering estate-focused services where most accountants don’t tread.

A confident, compliant accountant stands apart, especially when things get complex.

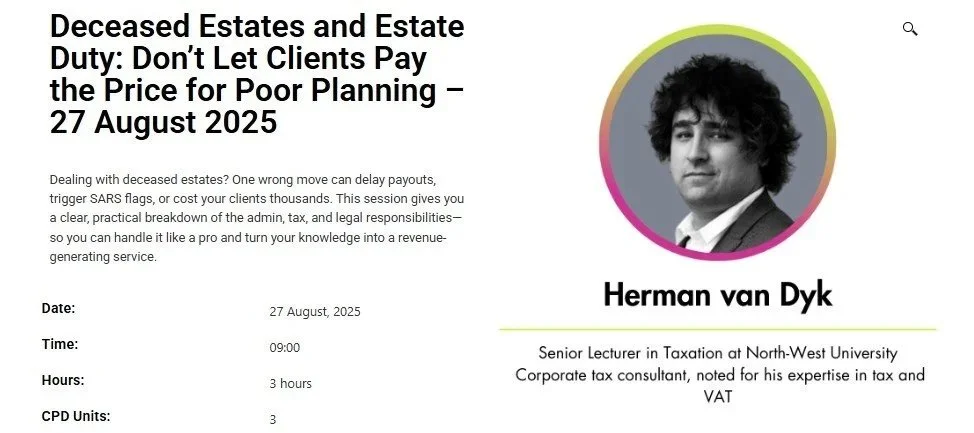

Master the estate administration processes and help your clients through these tough times. Enroll to CIBA’s live webinar on 27 August 2025 on Deceased Estates and Estate Duty: Don’t Let Clients Pay the Price for Poor Planning.

By attending this webinar you will gain the following competencies

Estate administration done right, step-by-step

What makes or breaks a valid will (and how to spot red flags)

How income tax and estate duty work at death, and how to avoid costly missteps