The Tax Idea Pre-Mortem: Killing Bad Ideas Before SARS Does

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

A single “clever” tax idea can save your client thousands today — and cost them millions tomorrow. In an era where SARS is sharpening its claws, accountants don’t just calculate tax. They decide which ideas live, and which ones must die before they ever reach an audit.

That’s where the Tax Idea Pre-Mortem comes in. It’s a practical tool you can use to pressure-test client strategies, spot the difference between solid tax planning and risky avoidance, and protect your clients — and yourself — from disaster.

The 7-Minute Pre-Mortem

Not every “tax-saving” idea is worth the risk. The Pre-Mortem is a structured checklist that helps you pressure-test an idea before SARS does. Think of it as a seven-step filter: if a transaction doesn’t survive here, it won’t survive an audit.

The 7 checks in practice:

No-Tax Story – Can you explain the idea in plain business terms without mentioning tax? For example, “We’re upgrading machinery to reduce scrap rates” makes sense. “We’re shifting profits to a shelf company” doesn’t.

Cash Map – Trace the flow of money. If it leaves one entity and returns to the same group the next day, with no change in risk or ownership, SARS will call it circular and collapse it.

People & Risk Map – Who actually makes decisions and carries risk? An entity with no staff or board meetings can’t credibly earn management fees.

Comparable Reality – Can you point to independent businesses doing this too, for non-tax reasons? If the only ones using the structure are scheme promoters, you’re in trouble.

Calendar Test – Do you have dated minutes, contracts, valuations or quotes before the transaction? Back-dated paperwork sinks good ideas.

Exit Cost – If SARS disallows it, what’s the cost? Add tax, penalties, interest, and reputational damage. If the downside is ten times the upside, why proceed?

One-Page Dossier – Summarise purpose, steps, cash flows, people, and evidence. If you can’t capture it clearly in one page, it’s probably too complicated to defend.

Green, Amber, Red: A Traffic-Light Approach

Not all strategies fall neatly into “legal” or “illegal.” Many exist in a spectrum. The traffic-light system gives you a quick way to categorise them.

Green (Safe, Documented Planning): These are straightforward strategies SARS expects taxpayers to use. For example:

Buying productive assets, like machinery or computers, that help the business run better — and claiming the allowed SARS wear-and-tear deduction

Using Small Business Corporation relief if the facts clearly support it.

Combining support services such as payroll and IT into one department, making sure employees, contracts and invoices show the work is real.

Retirement annuity contributions aligned to actual savings needs.

Amber (Proceed if Economics Are Real): These can be legitimate but require careful execution and strong commercial evidence. For example:

Intra-group IP licenses where the IP-owning company funds R&D, employs staff, and bears risk.

Shifting viable product lines into a loss-making subsidiary that has plant and people to turn it around.

Claiming business use of vehicles with proper logbooks, policies, and correct fringe-benefit treatment.

Red (High Risk, Avoid or Rebuild): These are classic avoidance moves that often collapse under General Anti-Avoidance Rule (GAAR). For example:

Charging management fees to an empty “service” company.

Round-tripping loans that exist only to generate interest deductions.

Allocating trust income to minors who never see or control the cash.

Using offshore shells where the real decision-making is still in South Africa.

Mini-Cases: From Avoidance to Planning

Many ideas aren’t inherently bad — they’re just poorly structured. With a few tweaks, you can often turn a red-zone scheme into a green-zone plan.

The Company Bakkie

Avoidance: Director drives it purely for personal use, no logbook, no policy.

Planning: The company implements a vehicle policy, keeps detailed logbooks, applies correct fringe-benefit tax, and logs actual deliveries.

Management Fee Schemes

Avoidance: Fees charged to a “management company” with no staff, no systems, no records.

Planning: Centralise real functions like payroll and IT into one entity, employ staff, create SLAs, and invoice on a cost-plus basis.

IP Transfers

Avoidance: Group moves intellectual property on paper, but the same developers and managers continue work as before.

Planning: Create a properly staffed IP company, fund new R&D, register IP rights, and benchmark royalties against third-party data.

These examples are powerful in client conversations. Instead of simply saying “no,” you can show how a bad idea can be rebuilt into something SARS-proof.

General Anti-Avoidance Rule (GAAR): Thinking Like SARS

The General Anti-Avoidance Rule (GAAR) gives SARS a broad net. It lets them disregard, recharacterise, or tax an arrangement if:

There’s no commercial substance (nothing changes except tax).

The steps are abnormal for a genuine business.

The main purpose is clearly tax-driven.

How to use it: When reviewing a structure, draft the first paragraph of the SARS letter you’d least like to receive. If it sounds convincing, the idea is already vulnerable.

Example triggers:

Dividend stripping: Declaring huge dividends before selling shares to reduce CGT.

Circular transactions: Selling an asset between group companies and buying it back later.

Hybrid instruments: “Loans” that look and act like equity, designed only for deductions.

If you can explain the transaction without mentioning tax, it’s usually safe. If the story only works with tax included, it’s likely avoidance.

Five Smart Moves This Year

The safest tax strategies aren’t exotic. They’re grounded in genuine business improvements that happen to carry tax benefits.

Here are five smart moves you can consider this year.

Energy efficiency upgrades with supplier financing — cuts utility costs and qualifies for allowances.

Debtors-day reduction through automation — improves cash flow and lowers taxable income via expenses.

Skills training with measurable outcomes — ties tax deductions to reduced errors, higher output, or improved charge-out rates.

Entity clean-ups — merging dormant companies reduces compliance costs and eliminates unnecessary risks.

Succession planning — staged buy-ins with documented governance shifts, supporting legitimate capital-gains treatment.

Suggesting these moves shows clients that tax planning isn’t about loopholes — it’s about smart business.

Scripts for Client Conversations

Clients often push accountants to “get creative.” These scripts help you handle the pressure while keeping relationships strong.

“My friend pays nothing in tax.”

→ “If they can show their board minutes, SLAs, staff lists and cash flows, we can copy the business. If not, it’s not a plan — it’s a risk.”“We need relief now.”

→ “Clever tricks fade under audit. Let’s choose a move that makes money without tax — then SARS can’t take it away.”“But the promoter says it’s approved.”

→ “Great — let’s see the ruling number, the exact facts, and the limits. Without that, it’s marketing, not protection.”

These ready-made lines turn awkward conversations into moments where you educate and lead.

The Takeaway

The difference between tax planning and tax avoidance isn’t just legal. It’s about substance, intent, and ethics.

Tax planning is good business, well documented. Tax avoidance is a fragile story that unravels under scrutiny.

The accountant’s role is clear: run the Pre-Mortem, build the evidence dossier, and stand behind ideas that make commercial sense even if tax laws didn’t exist.

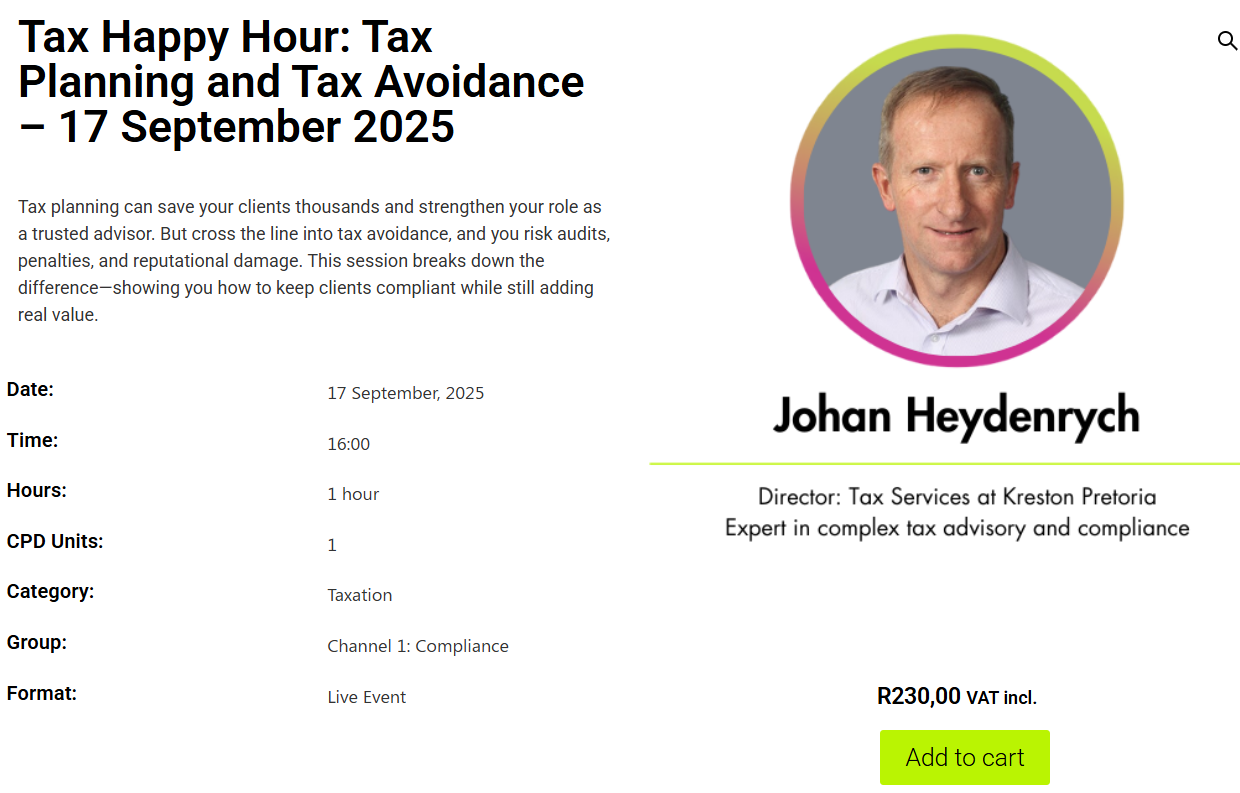

Join CIBA for a CPD on Tax Planning and Tax Avoidance here.

By attending this webinar you will gain the following competence

How to spot the fine line between legitimate tax planning and risky tax avoidance.

Practical strategies to save clients money while keeping SARS off their back.

Real-world examples of where accountants get it wrong—and how to avoid the same pitfalls.

How to position tax planning as a profitable service offering in your practice.