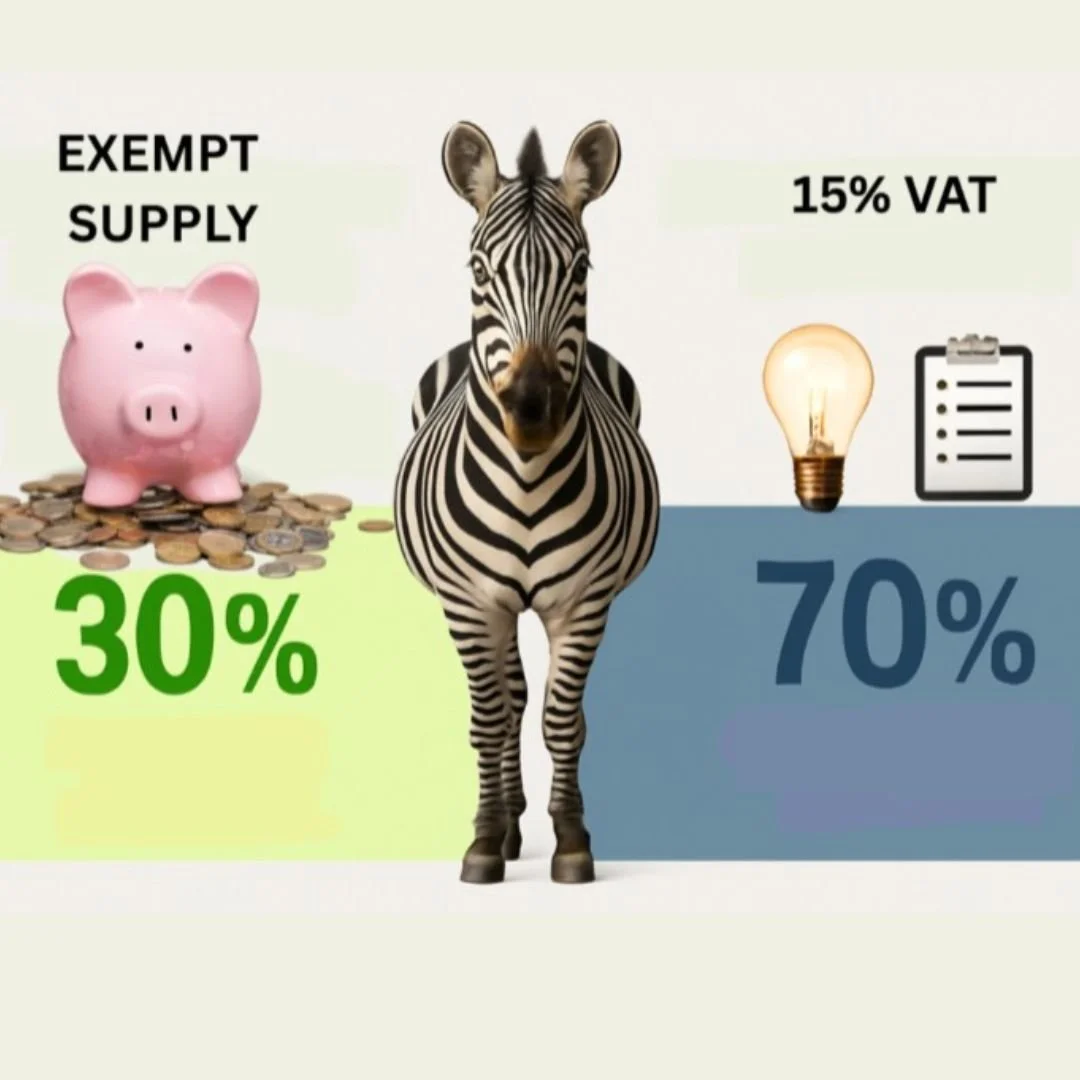

Mixed Up? Here’s What to Do When Your Business Has Both Vatable and Exempt Income

Think you’ve nailed your VAT strategy? Think again. From exempt supplies to mixed-income traps, recent court battles involving African Bank and Capitec show just how costly VAT missteps can be. In this article we look at exempt and vatable supplies, when you need to register for VAT, and what to do if your business earns both types of income. Get your VAT method right and save money and trouble with SARS!

‘Reckless Conduct’ versus ‘Intentional Wrongdoing’ - The Accountability of Tax Practitioners

Tax practitioners must uphold the integrity of the tax system, but what happens when ethical lines are crossed? The recent case of Naraidu v The State shows just how severe the consequences can be. Involving fictitious VAT claims and a tax practitioner caught in the middle, the case takes us from a conviction of fraud to an acquittal on appeal. Was it reckless action or intentional wrongdoing? We highlight the key lessons every tax professional should learn from this dramatic courtroom saga.