Latest Articles

Ethics

Practice Management

Technology

Taxation

Secretarial

Namibia

Praesent id libero id metus varius consectetur ac eget diam. Nulla felis nunc, consequat laoreet lacus id.

Accounting & Assurance

Advisory Services

Trending News

Tax FAQs

News from Regulators

Member FAQs

Accounting & Assurance FAQs

Practice Management FAQs

Become a CIBA Member

Your first step towards a professional designation.

Become a CIBA Member to enjoy full access. Fill out the form to speak with a consultant or schedule a call to learn more before committing to membership. We're here to help.

Already a CIBA Member?

Use the discount code provided on your CIBA Member profile at checkout and receive 100% discount.

Not a CIBA Member?

Already a CIBA member?

Log in to get your discount code

Join Accounting Weekly

R250.00 FREE

Every month

100% Discount when you become a CIBA Member. Join now to claim your CPD Hours. Register here: https://accounts.myciba.org/register

Practice Management

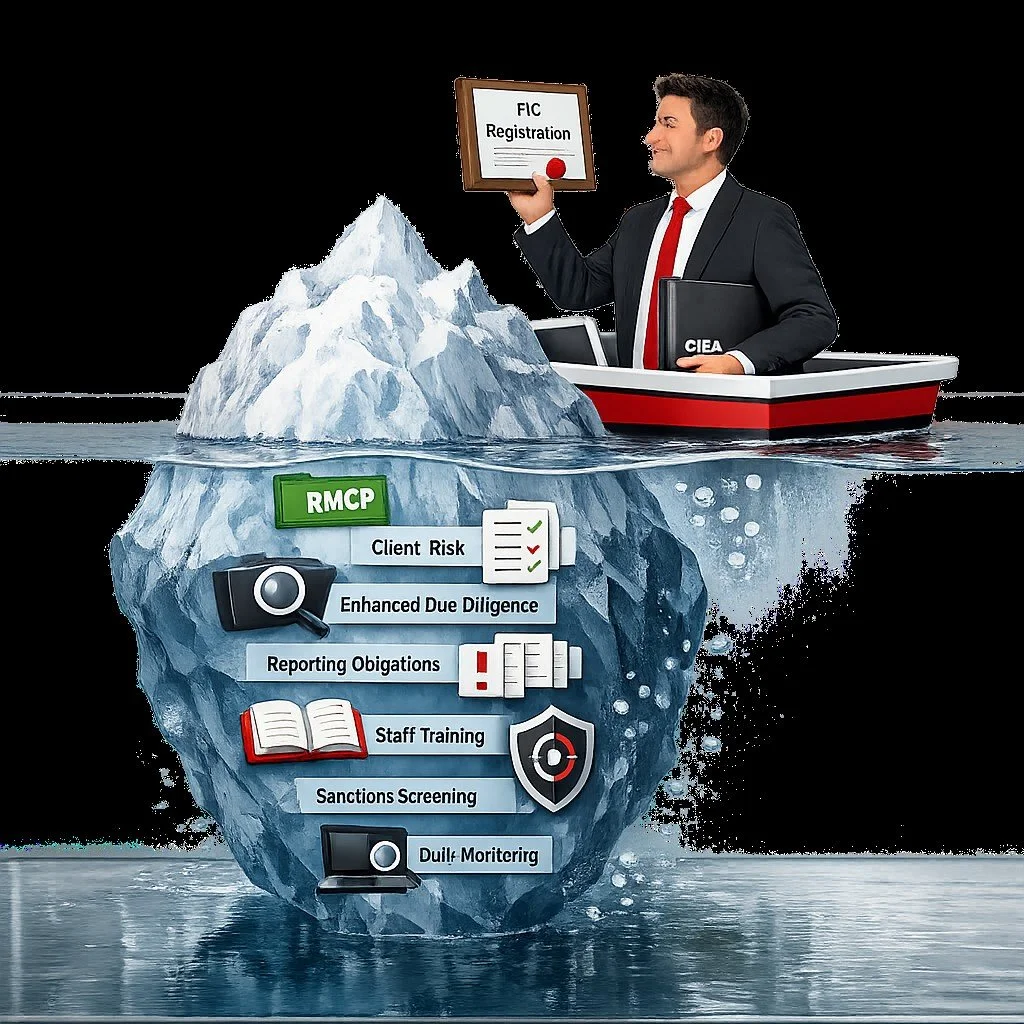

Registered with the FIC? That was the easy part. Now the real work begins. Too many firms think compliance is a once-off admin task, until an audit proves otherwise. FIC registration turns your practice into a permanently accountable institution, where every client, every transaction, and every employee decision carries regulatory risk. Here’s what every accountable institution needs to get right before the regulator comes knocking.

You did everything right. You qualified, complied, built a practice, earned client trust. Then a regulation told you no, not because you lack skill, but because the list was already full.

That moment triggers something familiar: defensiveness, frustration, disbelief. Not logic, instinct. The same instinct that freezes systems in time, protects incumbents, and treats new capability as a threat rather than a resource.

This article explores why Regulation 67 draws its line where it does, how that line affects real practices and real income, and why the tension you feel isn’t personal, it’s structural.

If you’ve ever been blocked by a rule that couldn’t justify itself, you’ll recognise this story immediately.

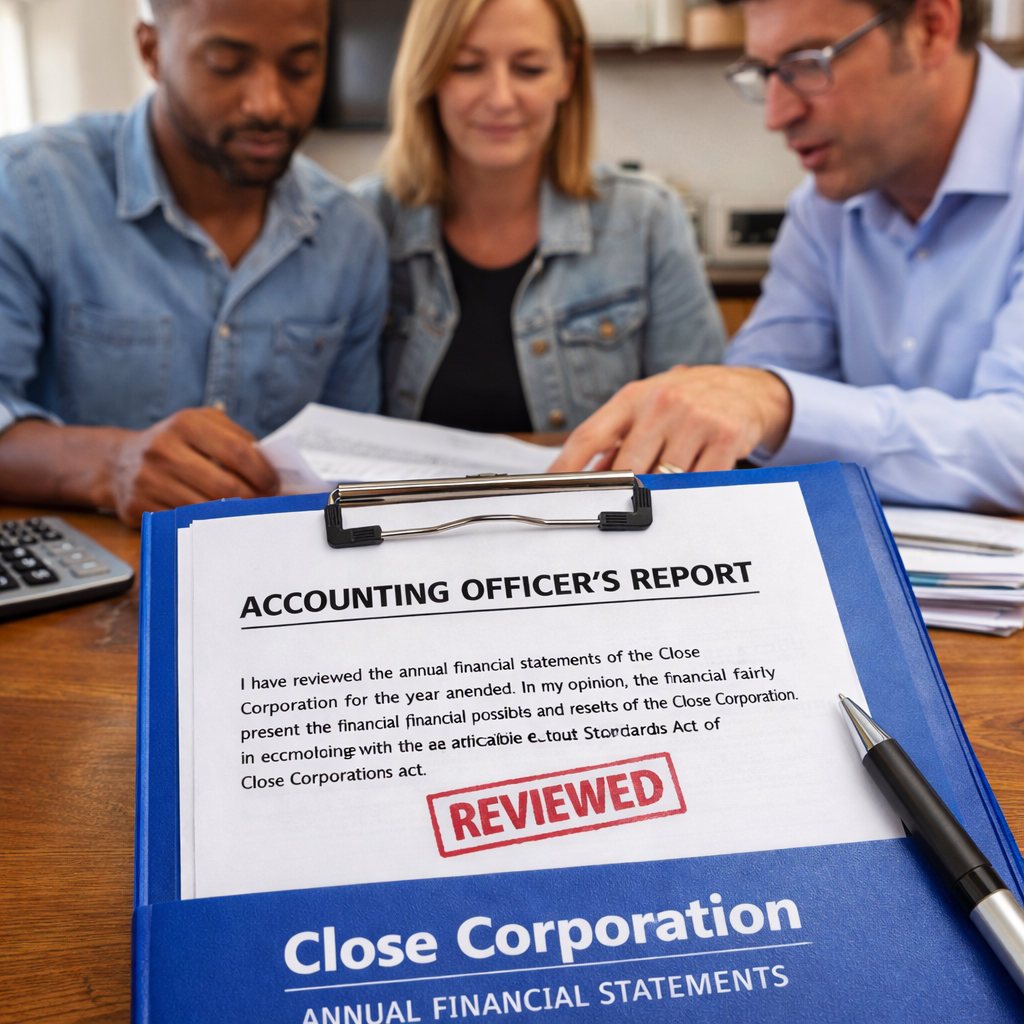

Most accountants don’t lose their practices because they’re incompetent. They lose them because they’re casual. Casual with scope. Casual with authority. Casual with documentation. And the law doesn’t forgive casual.

If you think “I’ve known this client for years” is protection, you’re already exposed. If your engagement letter hasn’t been touched since onboarding, you’re gambling. If half your advice lives in WhatsApps, voice notes, or favours you didn’t bill for, you’re not unlucky, you’re predictable.

This isn’t a comfort piece. It’s a mirror. And it might explain exactly how good accountants quietly lose everything.

Praesent id libero id metus varius consectetur ac eget diam. Nulla felis nunc, consequat laoreet lacus id.