A Taxman’s Casebook - Donations vs Valid Business Expenditures

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Lord Chancellor Edward, First Baron Thurlow (1731–1806) famously said:

“Did you ever expect a corporation to have a conscience, when it has no soul to be damned, and no body to be kicked?”

Even though corporations spend significant efforts and monies to be considered “responsible corporate citizens” with expansive social responsibility plans, it is extremely seldom that monies are expended by corporates purely with “gratuitous intent” out of “disinterested benevolence”.

Interest Free Loan to a Trust and Donations Tax

We recently received the following email from a large client:

“The company needs to make an interest free loan to an Enterprise Supplier Development (“ESD”) Trust. The loan contributes to our BEE scorecard. Must the ESD Trust pay donations tax in terms of Section 7C of the Income Tax Act?”

We responded as follows:

Donations tax is generally paid by the “donor” and not the “donee”. The ESD Trust is the recipient of the benefit and will not be liable for donations tax.

Section 7C does not apply since the loan to the ESD trust is not granted by the company “at the instance of a natural person” who is a “connected person to the company” to a Trust where such natural person or company are connected persons.

The loan is made to the ESD Trust, not out of gratuitous intent but to achieve a particular BEE scorecard level. Even if a cash donation was made to the ESD Trust, Donations Tax would not be payable since the amount paid would not fall within the definition of a “donation” in Section 55 of the Income Tax Act being “any gratuitous disposal of property including any gratuitous waiver or renunciation of a right.”

Donating Toys to Children’s Homes

Another query related to a toy manufacturer who donated toys (trading stock) to various a children’s homes. The income tax, donations tax and VAT treatment depend on the intent with which the toys were being donated:

If the toys were donated for a particular business reason, e.g. to achieve a particular BEE level:

The cost of the toys is tax deductible either as a section 11(a) deduction or as opening stock (S22).

There is no output VAT adjustment in terms of Section 18(1) of the VAT Act.

If the toys were donated with “gratuitous intent” out of “disinterested benevolence”:

Income Tax

The toy manufacturer must recoup the cost of the stock in terms of Section 22(8)(C).

If recipient issued a Section 18A certificate, then the toy manufacturer may claim the cost of the stock under Section 18A limited to 10% of taxable income.

Value-Added Tax

A section 18(1) output VAT adjustment must be made since the toys are not used “in the course of an enterprise”.

Donations Tax

Exempt from donations tax if the recipient is a registered PBO.

If the children’s home is not duly registered as a PBO, 20% donations tax is payable on the cost of the toys.

It is notable that even though the toys will constitute “donations” in the hands of the Children’s homes, it may not be a “donation” as defined for the toy manufacturer.

The tax practitioner is cautioned to carefully analyse the intent of each disposal before concluding that it qualifies as a “donation”.

Lessons For Tax Practitioners

The tax practitioner is cautioned to carefully analyse the intent of each disposal before concluding that it qualifies as a “donation”. The following practical procedures should be performed when analysing the tax implications of any disposal event:

Record Commercial Intent

Ensure management clearly documents the business purpose (BEE, supplier development, marketing, etc.) of the disposal. If the taxpayer cannot prove commercial intent, SARS may argue it was gratuitous.Confirm PBO Status of the recipient

Obtain written proof of valid PBO registration. If the entity is not properly registered, donations tax at 20 percent may apply.Verify Section 18A Certificates

Check that the organisation is authorised to issue the certificate and that the deduction falls within the 10 percent taxable income limit.Calculate VAT Before Disposal

If goods are not used in the course of enterprise, a Section 18(1) output VAT adjustment may apply. Quantify the potential liability.Review Recoupment Risks

Where donations in kind are made, consider potential section 8(4)(k) or Section 22(8)(C) recoupments.

Tax Risks can be pro-actively addressed by properly recording the facts, consider risks on a multi-disciplinary basis and support tax uncertain positions with formal tax opinions as envisaged in section 223 of the Tax Administration Act.

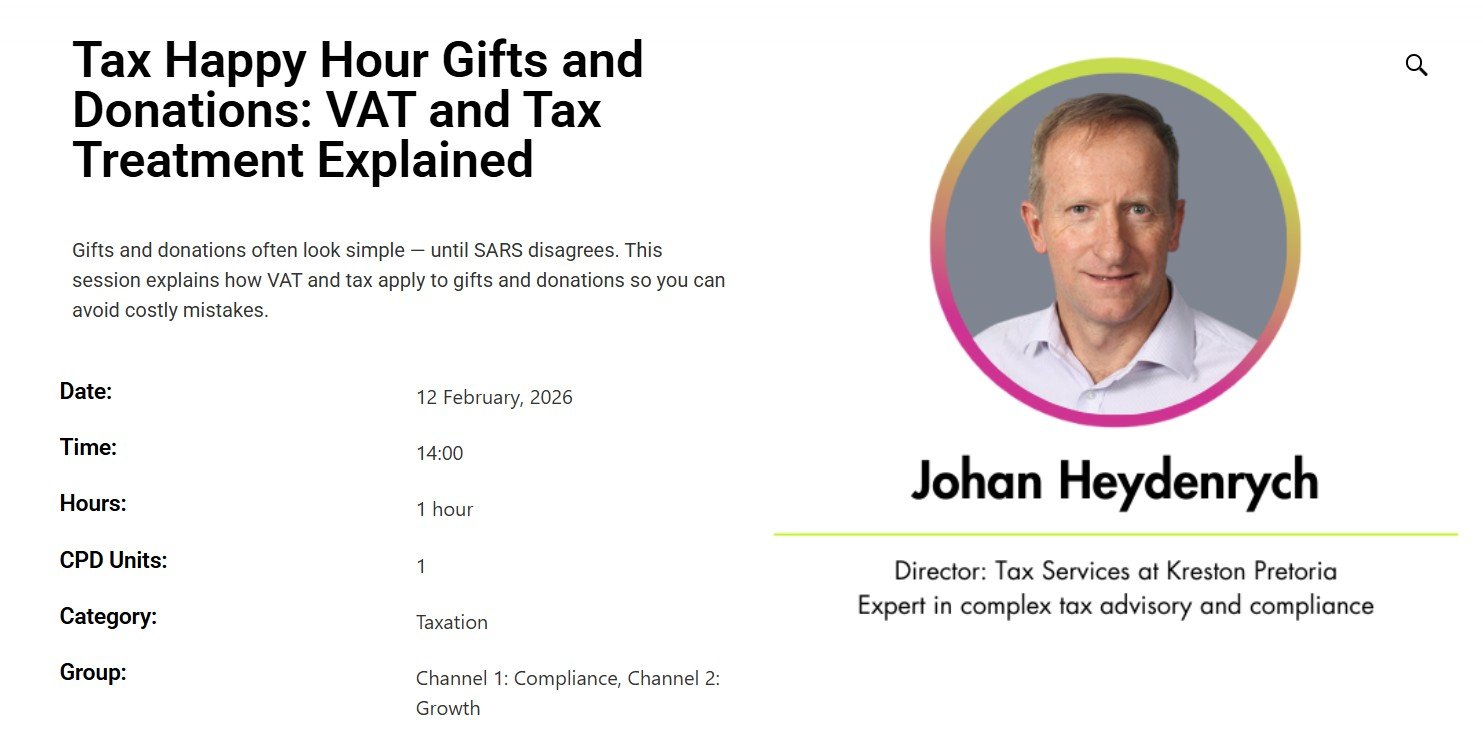

Join Johan for the CIBA’s Tax Happy Hour Gifts and Donations: VAT and Tax Treatment Explained

What You Will Learn

This session focuses on practical application to help you prevent costly mistakes and manage audit risk effectively. It will enable participants to:

Identify when gifts and donations trigger income tax, donations tax, or VAT consequences

Distinguish between different types of donations and their respective tax treatments

Determine the correct value to use for tax and VAT purposes

Recognise common errors made in practice and how to avoid them

Apply the correct accounting and disclosure treatment

Confidently advise clients on the risks and compliance requirements relating to gifts and donations.