The AI‑Augmented Accountant: Mastering the Art of the Prompt - Part 1 – Foundations & Frameworks

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Introduction: Why Prompting Is Now a Core Accounting Skill

For the South African business accountant, the landscape of professional practice is shifting rapidly. As members of CIBA, your role has always extended beyond mere compliance; you are the strategic partners to SMEs, the CFOs for businesses that cannot afford full-time executive financial leadership, and the guardians of financial integrity. Artificial Intelligence (AI) is not a replacement for this role but a powerful lever to enhance it. However, the output of any AI model, whether ChatGPT, Claude, or Microsoft Copilot, is only as good as the input it receives. This input is called a "prompt."

Mastering the art of prompting is no longer a technical hobby, it is a core business competency. For CIBA members, effective prompting unlocks the ability to draft tax opinions, analyse financial variances, and generate management reports in seconds rather than hours. This essay outlines the critical frameworks, strategies, and risk management protocols necessary to integrate AI prompting into your practice safely and effectively.

Why Prompting Matters in Accounting Practice

Prompting is the interface between human expertise and machine capability. In an accounting context, vague instructions yield generic, often dangerous advice. Precise prompting yields audit-ready insights.

Efficiency and Scale

A well-crafted prompt can turn a 3-hour task (e.g., summarizing changes in the 2025 Tax Administration Act relevant to construction SMEs) into a review task you can compete in a matter of minutes.

Standardisation of Quality

By defining exactly how an output should look, you ensure that every junior clerk in your firm produces work that meets a specific standard of quality and tone before it even reaches your desk.

Moving to Advisory

AI frees up mental bandwidth. Instead of spending hours formatting a cash flow forecast, you can prompt the AI to format the data, allowing you to spend your time explaining the implications of that forecast to your client.

High-Impact Prompting: A Tiered Toolkit

To consistently get high-quality results, accountants should move away from conversational chatting and toward structured prompting. We recommend a "Tiered Toolkit" approach using three distinct frameworks depending on the task: RTF for speed, CO-STAR for communication, and CRISPE for control.

🚀Level 1: The RTF Framework (For Speed & Admin)

Use this for quick, low-risk administrative tasks where speed is the priority.

R (Role): Give the AI a persona.

T (Task): Define the job.

F (Format): Define the output.

RTF is fast and simple, but that is also its biggest risk. Because it only sets Role, Task, and Format, the output is often broad and generic. It usually ignores country-specific laws, deadlines, internal systems, and client risks. If used for anything technical, it can produce misleading or unsafe advice.

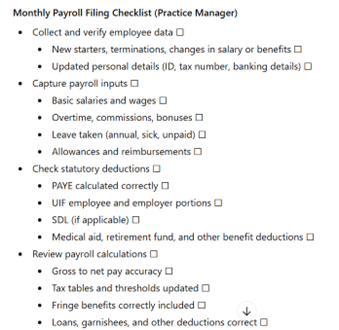

Example: "Role: Practice Manager. Task: Create a checklist for monthly payroll filing. Format: Bullet points and tick boxes."

Response from Chat GPT:

🚀Level 2: The CO-STAR Framework (For Communication & Connection)

Use this when the "human touch" matters—emails, letters, and advisory notes. The strength of CO-STAR is its focus on Tone and Audience, ensuring the message lands correctly emotionally.

C (Context): Who/what is the subject? (e.g., "The client is a struggling retailer").

O (Objective): What is the goal? (e.g., "Demand payment without losing the client").

S (Style): Writing style (e.g., "Professional but warm").

T (Tone): Emotional inflection (e.g., "Empathetic").

A (Audience): Who is reading this? (e.g., "The business owner, not the bookkeeper").

R (Response): Format (e.g., "Email draft").

CO-STAR focuses on tone, style, and audience. The message can sound warm, confident, and professional, but still contain incorrect facts. This is risky if the content involves tax, law, or compliance. It may “feel” right while being technically wrong.

Use CO-STAR when you need to persuade or connect (drafting emails, letters, marketing).

Example:

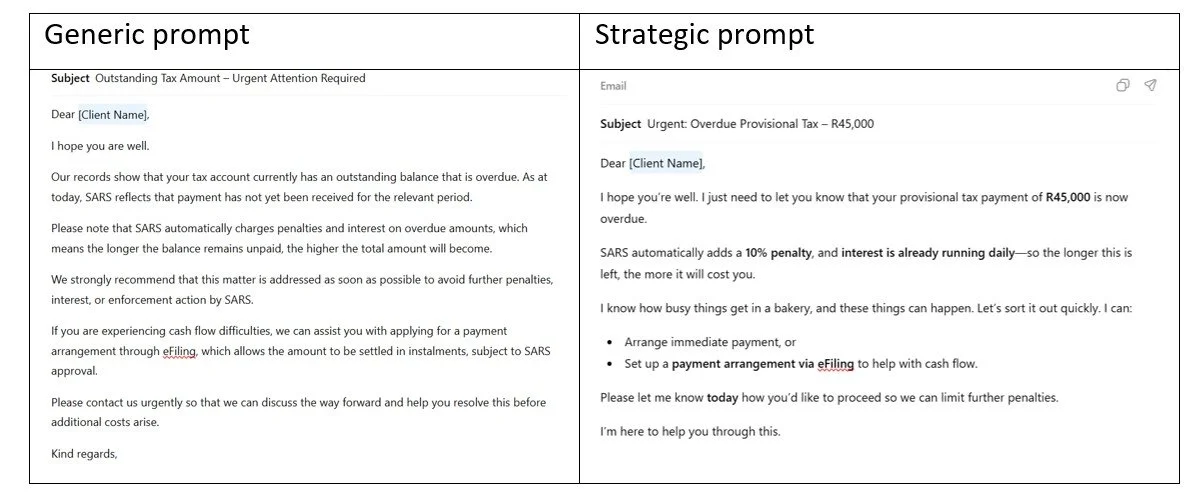

Generic Prompt: "Write a letter to a client about their overdue tax."

Result: A generic, robotic, and potentially inappropriate email.

CO-STAR prompt:

Context: The client is a long-standing SME bakery owner with an overdue

Provisional tax payment of R45,000.

Objective: Explain the overdue tax, SARS penalties are 10% and interest is accruing. Offer to set up a payment arrangement via eFiling.

Style: Professional.

Tone: Supportive but urgent.

Audience: The business owner, not an accountant.

Response: Email draft.

Responses from Chat GPT:

🚀Level 3: The CRISPE Framework (For Technical Analysis & Control)

Use this for complex tax, legal, or financial analysis where accuracy is non-negotiable. The strength of CRISPE is the Scope and Parameter elements, which act as "guardrails" to stop the AI from hallucinating or going off-topic.

C (Context): Background facts.

R (Role): Specialist persona (e.g., "VAT Specialist").

I (Intent): What do we need to produce?

S (Scope): What to include/exclude. (e.g., "Focus only on VAT, ignore Income Tax").

P (Parameter): Constraints. (e.g., "Reference only the SA VAT Act").

E (Example): A sample of the desired technical layout.

CRISPE adds strong controls, but it can create a false sense of security. Even with strict scope and parameters, the AI can still misunderstand laws or apply them incorrectly. There is also a risk of over-trusting the output and skipping proper professional review.

Use CRISPE when you need to Calculate or Comply. (Output: Tax Opinions, Ratios, Regulation Checks). For more detail and practical example on using CRISPE read our article Smart AI for Smarter Accountants: Use AI Responsibly and Intelligently published on 5 December 2025.

Conclusion to Part 1

AI prompting is not about replacing professional judgement, it is about structuring it. By applying appropriate frameworks, accountants can immediately improve efficiency, consistency, and output quality.

Part 2 will explore advanced prompting techniques, prompt libraries, governance, risk management, and professional responsibility.