Data Analytics + AI: The New Power Tools for Accountants

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Let’s be real—your clients aren’t asking for another spreadsheet. They’re asking for insights. Fast. They want answers to questions like:

“Where are we losing money?”

“Can we afford that expansion?”

“How do we prevent fraud?”

Here’s the truth: If you’re not using data analytics powered by AI, you’re guessing. And guessing won’t cut it in today’s high-stakes financial world.

Why Accountants Can’t Afford to Ignore Data Analytics Anymore

Your data is a goldmine—if you know how to use it. With AI and machine learning (ML), accountants can move from number crunchers to strategic advisors. And it all starts with better data.

Think of AI as a hyper-intelligent assistant that learns from data the same way a junior trainee learns from a senior partner—by being exposed to thousands of real examples.

🔍 Example: Just like a model trained to recognise cat photos by analysing millions of images, an AI system trained on years of invoices and payment histories can spot fraudulent transactions before they happen. That’s not future tech—that’s now.

What Makes AI Tick? It’s All About the Data

AI systems thrive on high-quality, relevant data. The better the data, the smarter the model. But here’s where most businesses fall flat:

🚫 Messy spreadsheets

🚫 Incomplete records

🚫 No clear structure or governance

Without proper data governance and cleaning, AI is just noise.

DO THIS: Start treating your firm’s data like a statement of financial position asset. It’s just as valuable.

Real-World Wins: What Accountants Are Already Doing with AI

AI isn’t just for big firms with big budgets. Here’s how accountants in both practice and commerce are already using AI to deliver faster results and deeper insights—without hiring data scientists.

Budget Forecasting: Predict Cash Flow Before It Becomes a Crisis

AI tools can generate forward-looking budgets by analysing historical data and identifying trends. But they’re only as good as the data you feed them.

Here’s how to get started:

Upload at least 12–24 months of historic financials (income statements, expense breakdowns, seasonal cash flows)

Include external factors like inflation, exchange rates or market cycles if possible

Tag one-off items (like COVID-related grants or once-off asset sales), so the AI doesn’t treat them as recurring

Use categorised data—e.g. separate fixed from variable expenses for clearer projections

The AI will output trendlines, monthly forecasts, and even scenario planning (e.g. “what if costs increase by 10%?”)

➡️ Result: You get an accurate, data-backed forecast that adapts over time—no more gut-feel budgeting.

Audit Automation: Detect Risk Without Sampling

Manual audits mean checking 5% of transactions and hoping for the best. AI lets you check everything—100% of the data, instantly.

Here’s how to get started:

Import the full general ledger or transaction log (preferably from the past 12 months)

Make sure each entry includes: date, vendor/client name, amount, category, and approval status

Highlight known risk areas (e.g. duplicate payments, manual overrides, round numbers, weekend approvals)

The AI scans for anomalies or patterns—flagging irregular transactions for your review

➡️ Result: You can run a “health check” across your books or client accounts in minutes, not days.

Client Insights: Spot Patterns, Tailor Services, Upsell Smartly

AI isn’t just about automation—it’s about knowing your clients better than they know themselves.

Here’s how to get started:

Gather data like: purchase history, payment timing, service usage, email queries, and support tickets

Group clients by characteristics (e.g. industry, revenue, risk profile, service type)

Use AI to detect behaviour patterns—who pays late, who’s growing fast, who might churn

Ask: “Which clients are most likely to need cash flow forecasting, tax advisory or compliance reviews?”

➡️ Result: You offer more relevant, proactive services—and clients feel like you really get their business

👉 If you’re not offering this level of insight, someone else will.

How to Actually Use Tech for Data Analytics (Without the Overwhelm)

You don’t need a full-time data scientist or a six-figure tech stack. Today’s tech tools are made for people like you—accountants who want insights, not IT headaches.

Here’s how your peers are already getting ahead with simple, smart tools:

🧰 Start with the Tools You Already Know

Spreadsheets + Data Modelling Add-ons

Don’t underestimate the software you already use daily. With built-in data modelling and transformation features, you can clean, combine, and analyse large data sets far more efficiently than before.Business Intelligence (BI) Dashboards

Use interactive dashboards to display real-time metrics like cash flow, budget variance or debtors ageing. These tools make it easy to translate complex financial data into client-friendly visuals.Accounting & Reporting Software

Many cloud-based accounting platforms now include built-in analytics or allow for integration with reporting tools. These systems can automatically generate trend reports, variance analysis, and client summaries—no manual exporting needed.

🤖 Automate the Admin and Free Up Your Time

Workflow Automation Tools

Use workflow automation tools to keep your data flowing between systems—like syncing financial data with your reporting tools or automatically updating performance dashboards. This reduces manual errors and saves hours every month.AI-Powered Assistants

Use conversational AI tools to clean messy data, run basic financial analysis, or even help generate formulas or scripts for specific queries. You ask, it delivers—no technical jargon required.

🧠 AI for Data Insights (Not Just Buzzwords)

Forecasting: Feed in historic financial data and receive predictive insights to guide decision-making.

Anomaly Detection: Spot unusual or risky transactions across large data sets before they cause problems.

Client Segmentation: Group clients by risk level, industry, or behaviour to offer targeted advisory services.

Don’t Skip the Data Governance Bit

The more tech you use, the more important it is to have rules in place:

✅ Who owns the data?

✅ Who can access it?

✅ How often is it cleaned and backed up?

✅ Are you compliant with POPIA?

Make sure your systems are secure, your data is reliable, and your processes are documented. You don’t need perfection—just a plan.

Yes, There Are Risks. But There’s a Way Around Them.

AI isn’t a free-for-all. You need to manage:

Data privacy – Are you POPIA-compliant?

Bias – Is your data complete and diverse?

Accuracy – Are you working with clean, standardised inputs?

Start by putting a data governance policy in place. It doesn’t have to be complex. Just document who checks what, when, and how. Small steps = big wins.

Still Wondering If It’s Worth the Effort?

🚀 PwC—one of the Big Four—used AI and data analytics to transform how they audit large clients. Instead of manually checking random samples, they built a system that reviews 100% of transactional data, using machine learning to flag unusual activity, high-risk journal entries, and compliance red flags.

The result?

Faster audits

Fewer errors

Deeper insights for clients

A massive boost in efficiency and trust

But here’s the kicker: this technology isn’t limited to big firms anymore. Scaled-down versions of these tools are available for SMEs, independent practices and finance teams—if you know how to feed them the right data.

You don’t need to build custom models. You just need to start using the data you already have, and let the right tools turn it into insights.

➡️ Think about it: If one firm can process millions of transactions with zero sampling, what could you do with the right tech and a few clean spreadsheets?

Final Thought: Don’t Just Report the Past. Predict the Future.

This isn’t about replacing accountants with robots. It’s about enhancing your expertise with tools that make you faster, sharper and more valuable.

You already have the experience. Pair it with the right data and tech, and you’re unstoppable.

CIBA Quick Checklist: Is Your Firm Data-Ready?

Here’s how to know you’re on the right track:

☐ We treat our data as a valuable business asset

☐ We use Excel’s Power Query or Power BI for reporting

☐ We’ve explored automation tools like Zapier or AI chatbots

☐ Our client insights are based on patterns, not guesswork

☐ We’ve documented a simple data governance process

☐ We check for data quality, completeness and relevance regularly

☐ Our team is upskilling in data analytics and AI

☐ We’ve tried ChatGPT or similar AI to improve our forecasting or reporting

☐ We’re using visual dashboards to communicate with clients or boards

☐ We’ve reviewed our POPIA compliance for client data

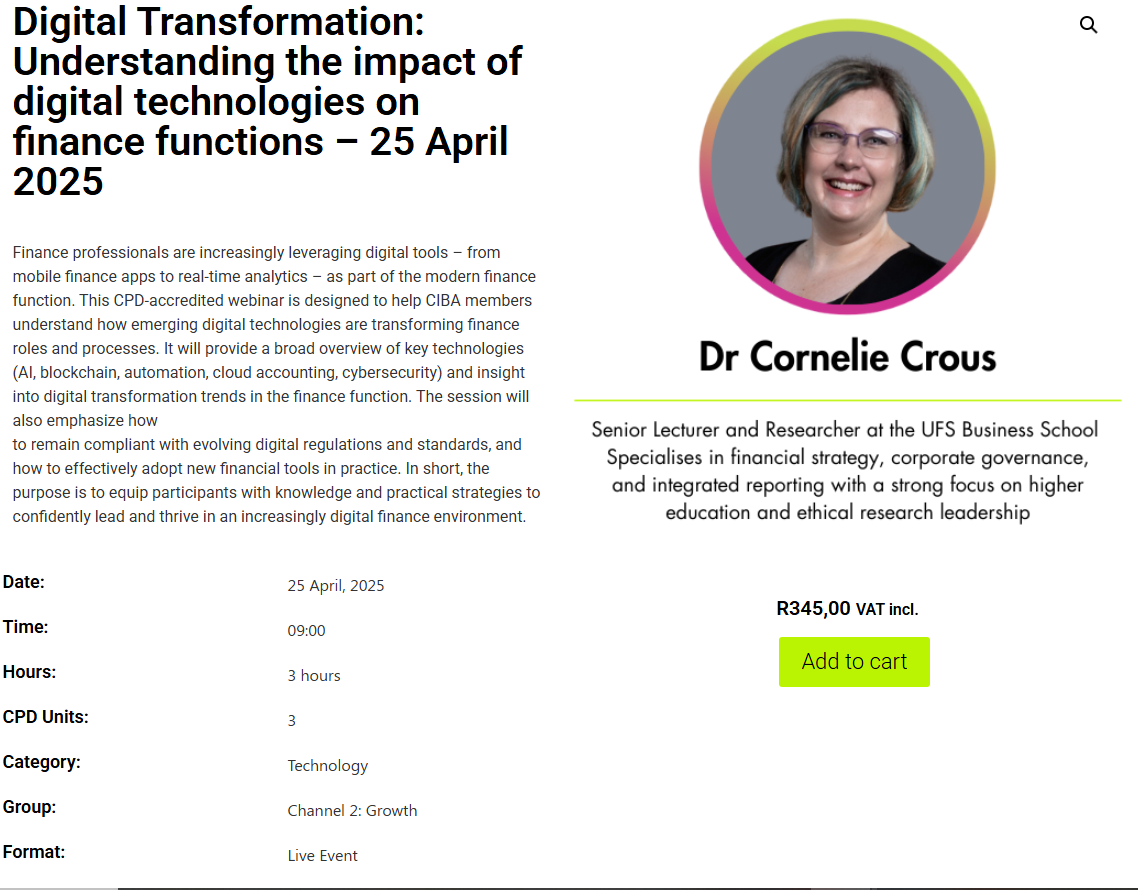

Join CIBA for a CPD on Digital Transformation: Understanding the impact of digital technologies on finance functions here.

By attending this webinar you will gain the following competencies

Staying Ahead of Trends: Gaining up-to-date knowledge of AI, blockchain, RPA, cloud accounting,

and other technologies shaping the future of finance. Attendees will be able to anticipate and lead

digital transformation initiatives in their finance teams.Ensuring Compliance: Understanding the latest digital regulatory requirements (e.g. data

protection laws, e-invoicing regulations) and best practices for cybersecurity, enabling them to

implement new tools while managing risk and compliance effectively.Applied Skills and Solutions: Learning through real-world case studies how to solve common

finance problems with digital solutions. This practical insight (e.g. how automation can cut process

time by 30–40% will help them drive efficiency and accuracy in their organizations.