Taxing the Farm: What Every Accountant Needs to Know

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Farming tax is a minefield of special rules, exemptions, and traps. Below is a practical summary of the complexities with examples, covering livestock, produce, packhouses, game farms and VAT.

Tax Laws Specific to Farming

Farming operations are governed by Section 26 of the Income Tax Act, with The First Schedule providing special computation rules. This only applies if genuine, full-fledged farming is being carried out, not just owning land.

📌Key point: You must prove it's actual farming, not just lifestyle use or passive income from renting out farmland.

➡️Example 1: Is it really a farm?

A client buys a vineyard in Cape Town, builds a house, and grows grapes for personal use. No intention to sell or run it commercially.

Verdict: ❌Not farming. No capital deductions, no special tax benefits.

If he actively maintains the vineyard, plans to sell produce, and treats it as a business (with staff, records, plans), then it may qualify.

Assessed Losses and Section 20A Ring-Fencing

If a farmer is:

Part-time → subject to ring-fencing as a “suspect trade”.

Full-time → may escape ring-fencing if they pass the “facts and circumstances” test.

Ring-fencing applies to individuals at the 39%+ marginal tax rate, with a few exceptions.

➡️Example 2: Lifestyle sheep farmer and ring fencing of losses

A taxpayer earns R800,000 a year from full-time employment in the city but owns a smallholding where he keeps a few sheep as a weekend hobby. Can he claim the loss from his smallholding against his employment income?

This is a classic case where Section 20A may apply. Because the taxpayer is not farming on a full-time basis, this is considered a "suspect trade." SARS is likely to view the sheep venture as a hobby or lifestyle choice rather than a genuine business.

✅Verdict: The loss will likely be ring-fenced unless the taxpayer can provide strong evidence that the sheep operation is run as a serious, profit-driven business. This includes maintaining proper financial records, having a business plan, showing commercial intent, and spending significant time on operations. Without this, the loss cannot be offset against his salary or other income and will be disallowed for the current tax year.

3. Trading Stock Rules

Farmers only include produce and livestock in their stock valuations. Consumables like fuel, seed, and fertiliser are excluded.

Produce must be valued at lower of cost or market value.

Standing crops (not yet harvested) = part of the land → not included.

➡️Example 3: Growing trees in a nursery

A nursery grows one-, two-, and three-year-old trees. When must they be valued?

✅Verdict: Only when ready for sale. If your business plan is to sell at 3 years, you don’t need to value the younger ones.

📌Warning: SARS will expect proof that you're not selling younger trees.

4. Livestock Deductions

SARS prescribes standard values for livestock, which are used for tax purposes regardless of what the animals actually cost. For example, a bull is valued at R50, and a lamb at R2, even though the market price is much higher.

When a farmer buys livestock during the year, they cannot deduct the full purchase cost immediately. Instead, the deduction for livestock purchases is limited to the sum of:

Gross income from farming, plus

The closing value of livestock on hand at year-end.

This limit does not apply to stolen, dead or sold livestock, and the farmer may claim the full deduction for those animals.

➡️Example 4: Dodging taxes with livestock?

A farmer buys R1 million worth of livestock, then claims a huge deduction. But his farming income is only R300,000.

✅Verdict: SARS will limit the deduction under paragraph 8(1), allowing only allowed up to R300k + closing stock. The rest of the cost carries forward.

If the livestock dies in a fire or is sold by year-end, the full deduction may be allowed.

Capital Expenditure: What Can Be Claimed

Farmers are entitled to claim deductions for certain capital improvements under Paragraph 12 of the First Schedule. However, the rules are split into two categories:

No Limitation (Claim in Full Regardless of Income)

These improvements can be deducted fully, regardless of your taxable income from farming:

Soil erosion control

Eradication of alien invasive vegetation

Limited to Taxable Farming Income

These are only deductible up to the amount of taxable income earned from farming (before deducting assessed losses). Any unused portion is carried forward to future years:

Dams, boreholes, irrigation systems

Fences and roads used in farming

Non-domestic buildings used for farming (e.g., barns, packhouses)

Planting of fruit trees, grapevines, or other long-term crops.

Important: These deductions are allowed only if the asset is used exclusively in your own farming operations. If the asset is used to serve others (e.g. packing their produce), you lose the Paragraph 12 benefit.

➡️Example 5: Shared-use packhouse = lost tax break

A farmer builds a R2 million packhouse. 60% is used for packing his own fruit, 40% is used for packing fruit from neighbouring farms.

✅Verdict: Because the facility is not used exclusively for the farmer's own operations, it does not qualify for a Paragraph 12 deduction.

Instead, the farmer must fall back on Section 11(e), which provides for a slow depreciation deduction, often as little as 5% per year. This greatly reduces the short-term tax benefit of the capital investment.

Wear & Tear and Accelerated Depreciation

If Paragraph 12 doesn’t apply, farmers can use:

Section 11(e) – standard depreciation

Section 12B – 50/30/20% for farming equipment

Section 12B(g) – renewable energy (solar) used in farming

➡️Example 6: Claim it all now!

A farmer buys a tractor and solar panels.

✅Verdict: He can claim:

50% of tractor cost this year (Section 12B)

Full cost of solar panels if used 100% for farming

No need to limit it to farming income. These are instant wins.

Game Farming vs. Game Lodges

Game income qualifies only if linked to animals, for example selling game, meat, or hunting fees to be considered farming. Providing accommodation, catering, holiday stays will be classified as non-farming.

➡️Example 7: Weekend hunting lodge

✅Verdict: A game farm charges guests for hunting (R15,000) and accommodation (R5,000).

R15k = farming income

R5k = non-farming, taxed like any other business.

VAT Considerations

Zero-rated purchases:

Feed, seed, fertiliser, animal remedies

Zero-rated food sales (raw, unprocessed)

No zero-rating for:

Takeaway foods or prepared items

Gift hampers with mixed items

Accommodation for workers (may trigger change-in-use VAT)

➡️Example 8: VAT slip-up

A farmer buys seed VAT-free for farming. Later, he uses the barn as employee housing.

✅Verdict: This triggers a VAT adjustment: he must pay output VAT on the market value of that part of the barn.

Final Takeaway

Tax on farming operations isn’t just “add up income, subtract expenses.”

From livestock limits to packhouse pitfalls, how you use your assets and who benefits from them can make or break your deductions.

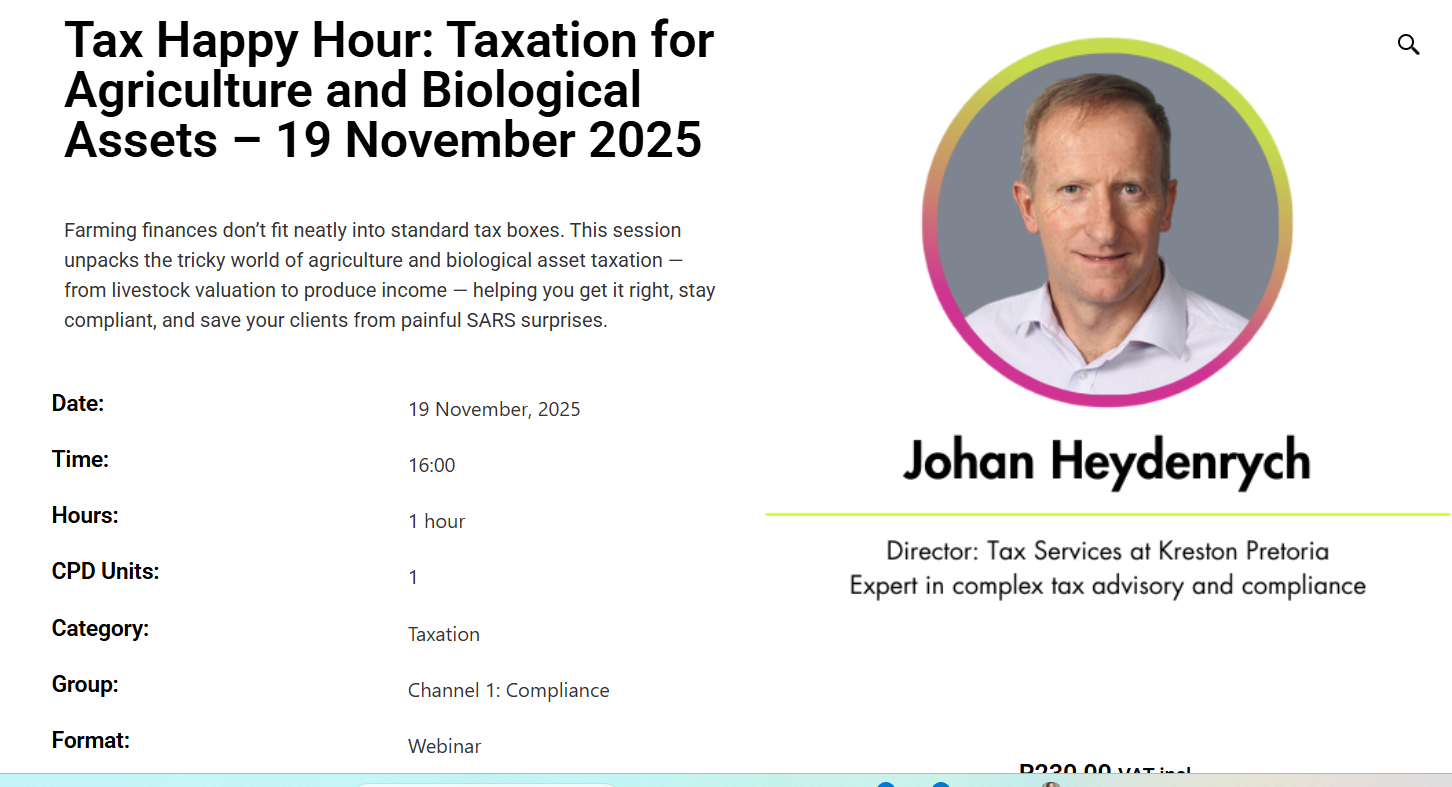

Join CIBA’s Tax Happy Hour and learn how you can assist farmers with their taxes over your cup of coffee!

By attending this webinar you will gain the following competencies:

Understand how tax law treats biological assets, consumable and bearer assets

Apply the correct principles for revenue, capital, and revaluation adjustments

Handle timing, recognition, and valuation challenges unique to farming operations

Manage deductions, allowances, and wear-and-tear rules for agricultural businesses

Identify common SARS audit triggers in farming and agribusiness entities

Advise clients confidently on compliance and planning opportunities within the tax framework