New VAT Ruling: Special Apportionment Methods for Retailers with Mixed Income

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

When a business makes both taxable and exempt supplies, it can’t claim all the VAT it pays on shared business expenses. Only the portion related to taxable supplies qualifies as input VAT. That means vendors must apportion their VAT claims to reflect how much of their spending relates to taxable activities.

Retailers who earn both taxable and exempt income streams, especially those using catalogues, showrooms, and e-commerce, now have more clarity from SARS on how to apportion input VAT correctly. Where vendors make exempt as well as standard supplies, the input VAT claimed on shared costs must be apportioned. In VAT Ruling VR 014, SARS confirmed the use of two specific apportionment methods by a home shopping retailer. The ruling applies to tax periods from 1 January 2024 to 31 December 2026, and while it is binding only on the applicant, it offers helpful guidance for other vendors in similar positions.

The Background of the Case

The applicant is a South African home shopping retailer with a national footprint of showrooms with no sales are made on-site. Instead, customers place orders through a call centre or online platform. The retailer earns income from four sources:

Sales of goods – taxable supplies

Initiation and service fees – taxable supplies

Interest on credit sales – exempt supplies (financial services)

Occasional sales of irrecoverable debtors’ books – exempt supplies (deemed financial services)

Because many of the business’s operational expenses relate to both taxable and exempt income, input VAT could not automatically be claimed in full. Instead, SARS had to approve a method to fairly apportion VAT on mixed-use expenses.

How SARS Classified the Expenses

The retailer categorised its expenses into five groups:

Category A: Used exclusively for taxable supplies – full VAT claim allowed.

Category B: Marketing and advertising costs for both taxable products and credit offerings – mixed use.

Category C: Telemarketing costs supporting both taxable and exempt sales – mixed use.

Category D: Admin and legal costs (billing, collections, customer analytics) – mixed use.

Category E: Used exclusively for exempt supplies – no VAT claim allowed.

SARS Ruling: Approved Apportionment Methods

To calculate input VAT on Categories B to D, SARS approved the following methods:

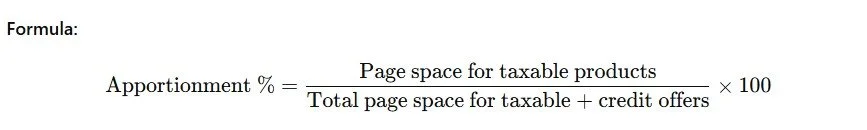

1. Page-Space Method (for Category B: marketing)

This method is tailored for advertising that promotes both taxable and exempt supplies within catalogues or brochures.

This allows the business to recover VAT based on how much catalogue space is used for selling taxable goods versus promoting credit options (which earn exempt interest income).

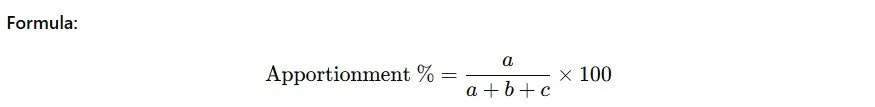

2. Varied Turnover-Based Method (for Categories C & D: telemarketing and admin)

This method is based on the proportion of taxable and exempt income earned.

Where:

a = value of taxable supplies

b = value of exempt supplies (including a portion of debtor book sales, adjusted using the Prime – JIBAR formula)

c = any other income not already included

This formula gives a more accurate reflection of the business’s operations and income mix than the standard turnover-based formula in BGR 16.

Why This Ruling is Important

This ruling highlights SARS’s willingness to approve custom VAT apportionment methods, provided they’re logical and well-substantiated. For accountants advising retail clients with diverse income sources, this opens the door to requesting tailored methods that better match business realities.

Key lessons:

If standard apportionment doesn’t reflect your client’s true taxable activity, apply for a binding ruling.

Track exempt vs taxable income streams carefully, especially interest, fees, and debt sales.

Use accurate, defendable methods like page allocation or adjusted turnover formulas to support input VAT claims.