How to Reallocate Tax Payments on eFiling

If you've ever made a payment to SARS that ended up in the wrong tax account (like VAT instead of Income Tax), there's now a quicker way to fix it. SARS has updated their system to allow payment reallocation requests to be submitted online via eFiling. Taxpayers and tax practitioners acting on behalf of clients can request payments to be reallocated for:

Income Tax

PAYE

VAT

Payments across different tax types, including non-core taxes. We were advised by a senior SARS official that reallocation of payments across different tax types, including non-core taxes, is permitted, provided that the taxpayer expressly instructs SARS to transfer the payment accordingly.

Payment Reallocation Requests

Payment reallocation requests can be submitted electronically via eFiling. Tax practitioners acting on behalf of taxpayers may use the "Submit a Payment Allocation Query" function to request the allocation of payments relating to Income Tax, PAYE, and VAT.

You can click on this link to proceed with the reallocation of payments: SARS Online Query (8.5.0.0 (PROD))

Outlined below are the steps to process a payment reallocation via eFiling.

How to do it - Step by Step

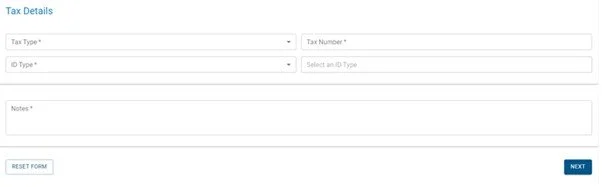

Complete the required fields:

If the “Submit a Payment Allocation” query was selected, the “Account Query” screen will be displayed. The mandatory fields will have an asterisk (*) next to them. All the mandatory fields must be completed.

Complete Personal Details as follows:

Personal details (title, initials, name, surname, contact info)

Tax details (select tax type, enter tax number, ID/passport/company/trust number)

Select the Tax Type from the dropdown list:

PAYE.

VAT.

Income Tax.

Enter the “Tax Number” relating to the Tax Type selected.

Select the ID Type from the dropdown list:

South African ID Number – If the taxpayer is an individual and a South African resident, only a valid ID number will be accepted.

Passport Number – If the taxpayer is an individual and a foreigner, a valid passport number must be used.

Company Registration Number – If the taxpayer is a Company. Only a valid Company Registration number will be accepted.

Trust Number – If the taxpayer is a Trust. Only a valid Master of the High Court Trust registration number will be accepted.

Capture the “ID No” depending on the ID Type selected.

Add notes in the “Notes” field to explain how the payments must be allocated. Make sure the notes are clear and understandable.

At any point, the taxpayer can click on the “Reset” button to clear all the captured information on the screen, this would also remove all the attached supporting documents, allowing the taxpayer to start the process again.

Note that the “Reset” button should only be used if all the information on the screen is incorrect.

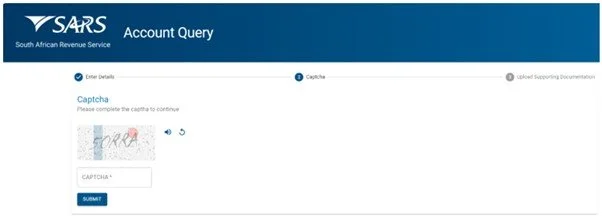

Click the “NEXT” button to proceed. The “Captcha” screen will be displayed.

Complete the onscreen Captcha as follows:

Complete the onscreen CAPTCHA field.

Click the “SUBMIT” button. The upload supporting documents screen will be displayed.

Upload Supporting Documentation (Optional):

Add clear notes explaining how the payment should be reallocated

If there is a supporting document to be uploaded, review the upload tips and ensure adherence to the rules.

Click on the “Upload” button next to “File Name” to browse your PC and locate the supporting documents to be uploaded.

Once the supporting document is attached, a “Delete” icon is enabled next to the attached supporting document.

Once complete, click the “SUBMIT TO SARS” button to send the captured details and attached documents to SARS. The following “Account Query Successful” message will be displayed: