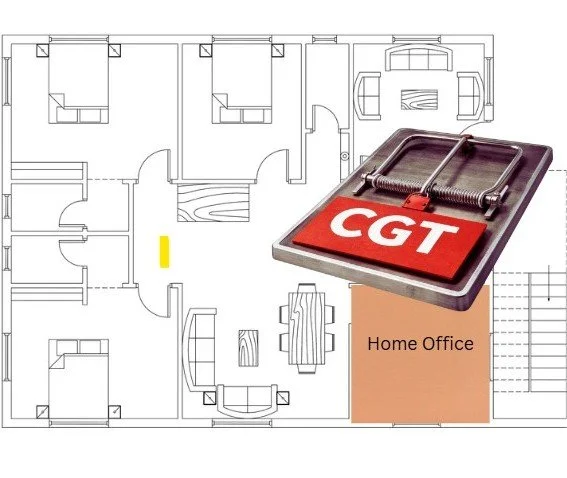

Home Office Deductions: The CGT Consequences Many Taxpayers Miss

Claiming a home office deduction feels like free money, a small win against rising costs and long work-from-home days. But that quiet tax saving can leave a long shadow. Years later, when a client sells their home expecting a CGT-free windfall, SARS may come knocking with an unexpected bill. This article exposes the hidden CGT tripwire in home office claims, and shows exactly when that “harmless” deduction turns into a costly mistake.

Capital Gains Tax 101: What It Is and How Does It Work?

Think CGT is just for the ultra-wealthy? Think again.

Whether you’re flipping shares, selling a second home, or advising clients on big asset moves, Capital Gains Tax can creep up and bite, unless you know the rules. In this article we bread down what counts, who pays what, and how smart accountants turn tax traps into savings. Real examples, real numbers, and a few golden exemptions you don't want to miss.