Non-Compliant Clients Make Tax Practitioners Look Bad

Tax practitioners are not just advisors but also role models in financial compliance. They must manage their taxes and their clients' taxes carefully. The Chartered Institute for Business Accountants (CIBA) is a recognised controlling body of South African Revenue Service (SARS) and holds its tax practitioners to high standards of integrity and compliance.

The Importance of Keeping Our Taxes Up to Date

As tax practitioners, every one of us needs to be on top of our tax duties. This isn’t only about following rules—it’s about maintaining the trust people place in us. Managing our taxes properly shows that we are reliable and trustworthy professionals.

What the Law Says

All registered tax practitioners must keep their tax affairs in order without any backlogs in payments or filings. The Tax Administration Act of South Africa is clear. Section 240(3)(d) specifies that tax practitioners who fail to maintain full compliance with their tax obligations for a total of at least six months over the past year may face actions by SARS. CIBA requires all tax practitioners to provide annual tax clearance certificates, but this is simply not enough. It is up you to keep your taxes in good order, otherwise SARS may take serious actions, which can include penalties or even removing us from the register of tax practitioners.

Lead by Example – Get Your Own Tax Affairs In Order

Setting a good example is crucial. Regularly check that your tax filings and payments are current, and ensure that your registered details with SARS are up to date. This helps in receiving all necessary communications from SARS and maintaining your status as a compliant practitioner.

Promote Compliance Among Clients

While tax practitioners are not legally responsible for ensuring that their clients pay their taxes, they have a moral and ethical responsibility to encourage compliance. SARS relies on the services of tax practitioners to inform clients of their tax obligations and ensure that they fulfil these obligations timely. Tax practitioners should:

Maintain clear records of client tax obligations and deadlines.

Send timely reminders for document submission and tax payments.

Verify payment confirmations with clients to ensure deadlines are met.

Stay informed about SARS updates to provide accurate advice.

Check clients’ tax compliance status regularly and take timely steps to remedy non-compliance before it becomes a problem.

How to Handle Non-Compliant Clients

Handling non-compliant clients is a significant aspect of a tax practitioner's duties. It requires a combination of diplomacy, adherence to professional standards, and sometimes, tough decision-making. Here’s a detailed approach on how to manage clients who fail to meet their tax obligations:

1. Establish Clear Communication

From the outset, set clear expectations with your clients about their responsibilities and the consequences of non-compliance. Ensure they understand the importance of meeting deadlines for tax submissions and payments. Provide them with a schedule of due dates, and remind them regularly.

2. Educate Your Clients

Often, non-compliance arises from a lack of understanding. Take the time to educate your clients on the specifics of tax laws relevant to their situation. Explain the potential penalties and interest on late payments or filings, and the broader implications of non-compliance, such as audits or legal action.

3. Implement a Robust Follow-Up System

Use a reliable system to track client compliance, including:

Regular reminders via email or phone as deadlines approach.

Check-ins to confirm receipt of necessary documentation.

Alerts when you have not received confirmation of payment or submission of returns.

4. Document All Interactions

Keep detailed records of all communications with clients regarding their tax obligations. This documentation should include copies of sent reminders, notes from conversations, and any responses from the client. This practice will be invaluable if you need to demonstrate your efforts to promote compliance or if you decide to end your professional relationship due to ongoing non-compliance.

5. Offer Solutions

If a client is struggling with compliance due to financial difficulties or organizational issues, help them explore solutions. This might include:

Setting up a payment plan with SARS.

Advising on cash flow management to meet tax obligations.

Assisting with applications for relief measures, if available.

6. Address Persistent Non-Compliance Firmly

If non-compliance continues despite your efforts, take a firmer stance:

Notify the client of the potential for more severe consequences, including the risk to their business operations.

Reiterate your role and responsibilities as a tax practitioner, emphasizing that continuing non-compliance might force you to disengage as their service provider.

Consult legal or professional guidance if the situation does not improve, to understand your rights and responsibilities.

7. Consider Disengagement

As a last resort, if a client repeatedly ignores compliance requirements and your advice, consider formally ending your professional relationship. Ensure that any disengagement is done according to ethical guidelines, with sufficient notice to the client and a clear explanation of the reasons for your decision.

8. Report to Authorities When Necessary

In cases where non-compliance is intentional and involves fraudulent activity, you may be required to report this to the authorities. Be sure to understand your legal obligations under your local laws regarding reporting such issues.

SARS' Role in Monitoring Compliance

All tax practitioners should be aware that SARS actively monitors both tax practitioners and their clients for compliance. CIBA receives quarterly compliance reports from SARS refleting total figures for all its registered tax practitioners. When persisting non-compliance is found SARS reaches out to tax practitioners directly, allowing them to remedy the situation. When non-compliance remains, it can lead to deregistration as a tax practitioner, reflecting the importance of maintaining strict adherence to tax laws.

Stay Above Board with Us

Keeping up with tax rules isn’t just about avoiding trouble. It’s about proving that we are dependable and trustworthy. Let’s lead by example. Staying fully compliant shows that we are committed to our professional duties and to maintaining public trust. Contact us at technical@myciba.org should you receive communication from SARS regarding your persistent non-compliance status.

CIBA needs a personal commitment from tax practitioners to stay informed and compliant with all tax laws. We urge all tax practitioners to regularly check your own and your client's tax status. If you find problems, address them quickly. It’s essential for maintaining the standards expected of us as members of CIBA and as part of South Africa’s community of tax practitioners.

Communicate to your clients using our handy template letter below

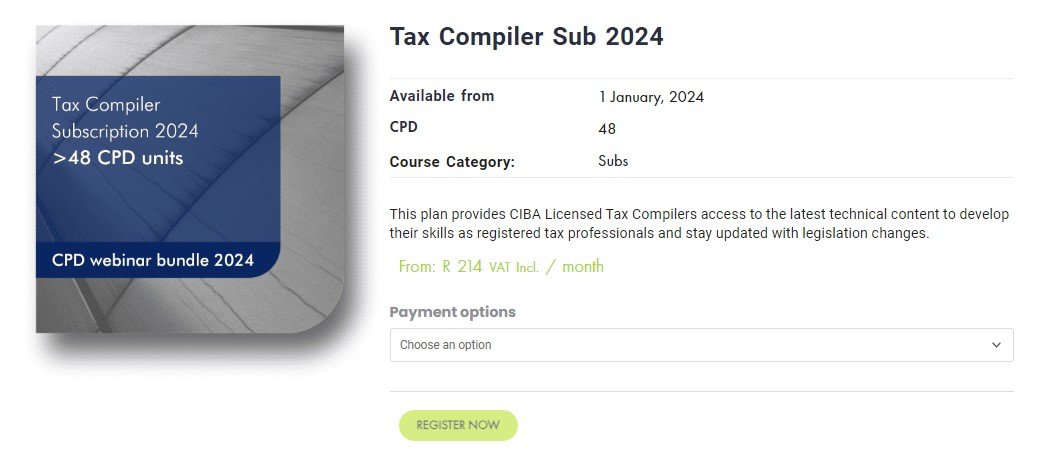

Keep up to date with CIBA’s Tax Compiler and Tax Advisor subscriptions

By subscribing to the Tax Compiler or Tax Advisor Subscription you will gain access to monthly webinars covering various topics; which will enable you to:

Be aware of the latest legislative changes and what it means for your business, practice, and your clients;

Prepare compliant taxation returns fast;

Issue reliable taxation calculations on financial statements;

Understand the laws and regulations that govern taxation; and

Perform tax compiler services.