Hope, Reforms, and Reality: What the 2025 MTBPS Means for Us

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Opening & Introduction

It comes as no surprise that the Minister referred to the false accusation of genocide against the white community in South Africa. The so-called “genocide narrative” is unfounded, yet has been used to justify calls for sanctions. Prominent members of that very community have rejected this falsehood, choosing solidarity, equality, and justice over fear and hate. Their courage reminds us of our shared responsibility to build a future rooted in truth and mutual respect.

Government continues to pursue macroeconomic stability that is essential for growth and living standards. But stability depends on domestic peace and reduced global tensions. Conflicts disrupt trade, fuel migration, and inflate prices, threatening our economic resilience.

Despite these challenges, South Africans have reason to be optimistic. Progress has been made on key commitments:

Faster growth

Stronger public finances, and

Improved quality of life.

Two years ago, government pledged to stabilise debt by this year and despite low growth, we are on track. South Africa also exited the FATF grey list within two and a half years —thanks to collaboration across sectors and the diligence of taxpayers and accountants submitting IT3(t) forms. This tool has helped trace money-laundering activities. Well done, accountants!

But the work continues as FATF’s next evaluation begins in 2026. We must stay vigilant.

Global Economic Outlook

The October 2025 World Economic Outlook released by the International Monetary Fund (IMF) projects that global growth will slow modestly—from 3.3 percent in 2024 to 3.2 percent in 2025 and moderate further to 3.1 percent in 2026.

Although tariffs have not risen as sharply as initially anticipated when the U.S. Administration announced new trade measures in April 2025, the delayed price effects of these measures—combined with growing protectionism and persistent supply chain disruptions—may still push up global costs.

The prospect of higher tariffs temporarily boosted global trade earlier in the year, as businesses accelerated imports and exports in anticipation of increased costs. However, this effect is expected to fade over the remainder of 2025.

Meanwhile, the price of gold has surged, reflecting its traditional role as a safe-haven asset in times of geopolitical and economic uncertainty. With the global economy weighed down by both military conflicts and trade tensions, gold continues to act as a “reliable currency.”

It remains to be seen whether this rise in gold prices will result in an unexpected windfall in state revenue, as was the case during previous commodity price surges.

Local Economic Outlook

Global economic growth is projected to slow slightly to 3.2 percent in 2025, reflecting the effects of persistent trade tensions, geopolitical uncertainty, and ongoing supply chain disruptions.

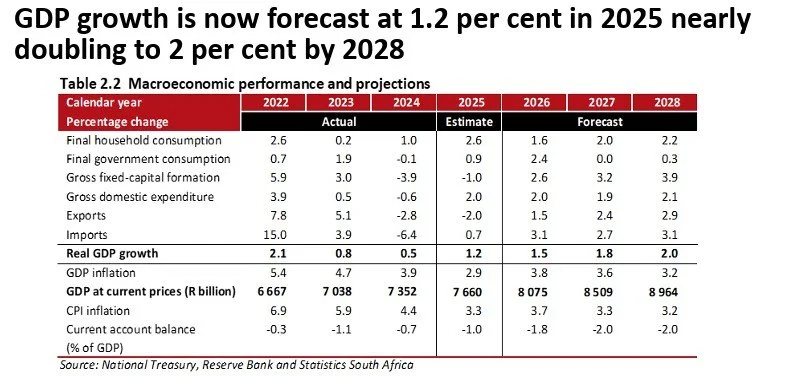

Domestically, South Africa’s real GDP growth (as adjusted for inflation) is forecast at 1.2 percent for 2025, down from the 1.4 percent estimated in the 2025 Budget. Over the medium term, real GDP growth is expected to average 1.8 percent over the next three years.

Although the impact of the unilateral tariffs imposed by the United States has not been as severe as initially anticipated, their delayed effects, together with the rise in global protectionism, continue to pose risks to productivity and price stability.

In this environment of uncertainty, it is essential that South Africa maximises opportunities within the sub-Saharan region. The country continues to make progress in implementing the African Continental Free Trade Agreement (AfCFTA), which is a key instrument for strengthening multilateralism, deepening regional cooperation, and unlocking new pathways for sustainable growth across the continent.

Inflation Target and Monetary Policy

Government has announced a new inflation target of 3 percent, with a 1 percentage point tolerance band on either side. This band provides flexibility to accommodate unexpected inflationary shocks while maintaining price stability. This decision aligns with South Africa’s long-standing flexible approach to inflation targeting, which allows for short-term deviations without compromising the long-term objective of stable prices.

The new target immediately replaces the previous range of 3 to 6 percent and will be implemented gradually over the next two years. Over time, a lower target is expected to reduce inflation expectations and actual inflation, thereby creating room for lower interest rates.

👉Lower inflation rates will in turn support household spending and business investment, providing a boost to economic growth and job creation. In simple terms, it reduces the cost of living for South Africans.

While the shift to a lower inflation target may entail short-term fiscal costs—such as slower nominal GDP and revenue growth—these are outweighed by the long-term benefits of enhanced price stability, investor confidence, and sustainable growth.

Progress on structural reforms

Significant progress continues to be made in advancing structural reforms across key sectors of the economy.

⚡Energy Sector

In the electricity sector, Eskom has expanded available generation capacity and reduced unplanned outages. As of 29 October 2025, South Africa has achieved 167 consecutive days without load shedding—a major milestone. More than 2,220 megawatts of new solar, wind, and battery storage projects are under development, including 720 megawatts at advanced stages of construction.

The National Transmission Company of South Africa is finalising market rules to govern the emerging wholesale electricity market, promoting competition and ensuring efficient pricing.

🚆Transport and Logistics

In the transport sector, Transnet’s rail volumes increased in 2024/25, although performance remains below target. To enhance efficiency and capacity, private-sector participation in rail and ports has been expanded. Currently, 11 private train operators have been allocated slots on 41 routes across six major corridors—a key step towards revitalising the logistics network.

💧Water Sector

In the water sector, the Water Partnership Office is collaborating with five metropolitan municipalities to reduce water leaks and improve financial and operational performance. Earlier this year, the Africa Water Investment Summit secured US$12 billion in commitments for 80 projects, including 36 in South Africa—a clear demonstration of investor confidence in the sector’s reform agenda.

🌍Tourism and Visa Reform

Reforms to attract critical skills and grow tourism have also gained momentum. Visa processes for tour operators serving the Chinese and Indian markets have been simplified, facilitating travel to South Africa. Additionally, the electronic travel authorisation system is being rolled out to enable online visa applications from China, India, Indonesia, and Mexico, making it easier for visitors to experience South Africa’s tourism offerings.

👷Employment

The unemployment rate deteriorated by 1.3 percentage points in the first half of 2025, reaching 33.2 percent in the second quarter.

Although there are now over 386,000 more jobs in the economy compared to 2019, on the eve of the COVID-19 pandemic, labour force growth has outpaced job creation. As a result, the number of unemployed people has increased by about 1.6 million, the majority of whom are new entrants to the labour market.

Revenue collections

Revenue collection for the first six months of the 2025/26 fiscal year amounted to R924.7 billion, representing a 9.3 percent increase compared with the same period last year and R17.5 billion above the 2025 Budget estimate.

To strengthen its capacity, the South African Revenue Service (SARS) was allocated an additional R7.5 billion over the 2025 Medium-Term Expenditure Framework (MTEF) period. These resources are being directed toward recovering large outstanding tax debts and investing in new technology, data science, and artificial intelligence to enhance collection efficiency and transparency.

The positive impact of these investments on overall revenue performance will materialise gradually over time. Government will continue to monitor SARS’s revenue performance closely to assess whether the R20 billion in additional tax increases proposed for the 2026 Budget—as announced in the 2025 Budget—can be withdrawn. A final decision will be made and communicated in the 2026 Budget.

Relative to the 2025 Budget, the gross tax revenue estimate for 2025/26 has been revised upward by R19.7 billion. Key factors influencing in-year revenue collection include:

Domestic VAT collections grew by 7.8 percent, supported by resilient household consumption.

Weaker economic activity and stricter enforcement measures to curb fraudulent claims have slowed the growth in VAT refunds.

As a result, net VAT collections are expected to exceed the 2025 Budget estimates.

Expenditure Priorities

For the current year, additional expenditure of R15.8 billion is proposed. The revenue overrun narrows the 2025/26 budget deficit and enables government to add funding for spending priorities and frontload capital investments.

Amongst the in-year adjustments is also R2 billion for the rebuilding of Parliament, and R1 billion to the Independent Electoral Commission for the 2026 municipal elections.

In addition, the spending announced in the May Budget for the National Dialogue, as well as its carry through costs, are catered for.

These allocations are on top of the additional funding provisions for Education and Health announced in the May Budget.

Budget Facility for Infrastructure (BFI)

Government reconfigured the Budget Facility for Infrastructure to run four bid windows annually instead of just one. Since the reconfiguration, the BFI has received 28 submissions. Nine projects were accepted for detailed analysis. Funding to the tune of R4.1 billion is also allocated for disaster relief to fix schools, pipelines, clinics and substations damaged between last year and this year by flooding in KwaZulu Natal, Mpumalanga, and the Eastern Cape.

To raise the funding for these BFI projects, a new infrastructure bond will be launched soon to raise a minimum of R15 billion.

Over the medium-term consolidated spending will increase from R2.6 trillion this year to R2.9 trillion in 2028/29. The lion’s share of consolidated non-interest spending, approximately 61 per cent over the next three years, continues to fund the basket of government-provided services and benefits that reduce the cost of living for citizens.

Targeted and Responsible Savings (TARS)

To build on work on spending reviews, targeted and responsible savings are underway.

Eliminating waste and inefficiency in government is non-negotiable if we are to maintain public trust that tax money is spent responsibly. The Targeted and Responsible Savings (TARS) initiative systematically identifies duplication, eliminates waste, and reorganizes programmes to deliver value for money.

We are implementing medium-term savings of R6.7 billion by closing or scaling down low priority and underperforming programmes immediately.

More than half of this involves identifying people who are double-dipping and defrauding the social grants system.

Conclusion

So, what does this Medium-Term Budget Policy Statement (MTBPS) really do? Like similar statements before it, it gives us reason to hope — and without hope, we are indeed hopeless.

It is encouraging to see that resources are being directed to the right priorities and that policy continues to move in the right direction. However, the real test lies in implementation — in translating plans into action, appointing capable contractors, ensuring timely delivery, and completing projects within set timeframes. These tasks are complex and often extend well into the next financial year.

In the end, hope remains our most valuable resource — and while it may not be enough on its own, it is far better than being without it.

For more information access the MTBPS documents below: