FIC Compliance After Registration - What You Should Know

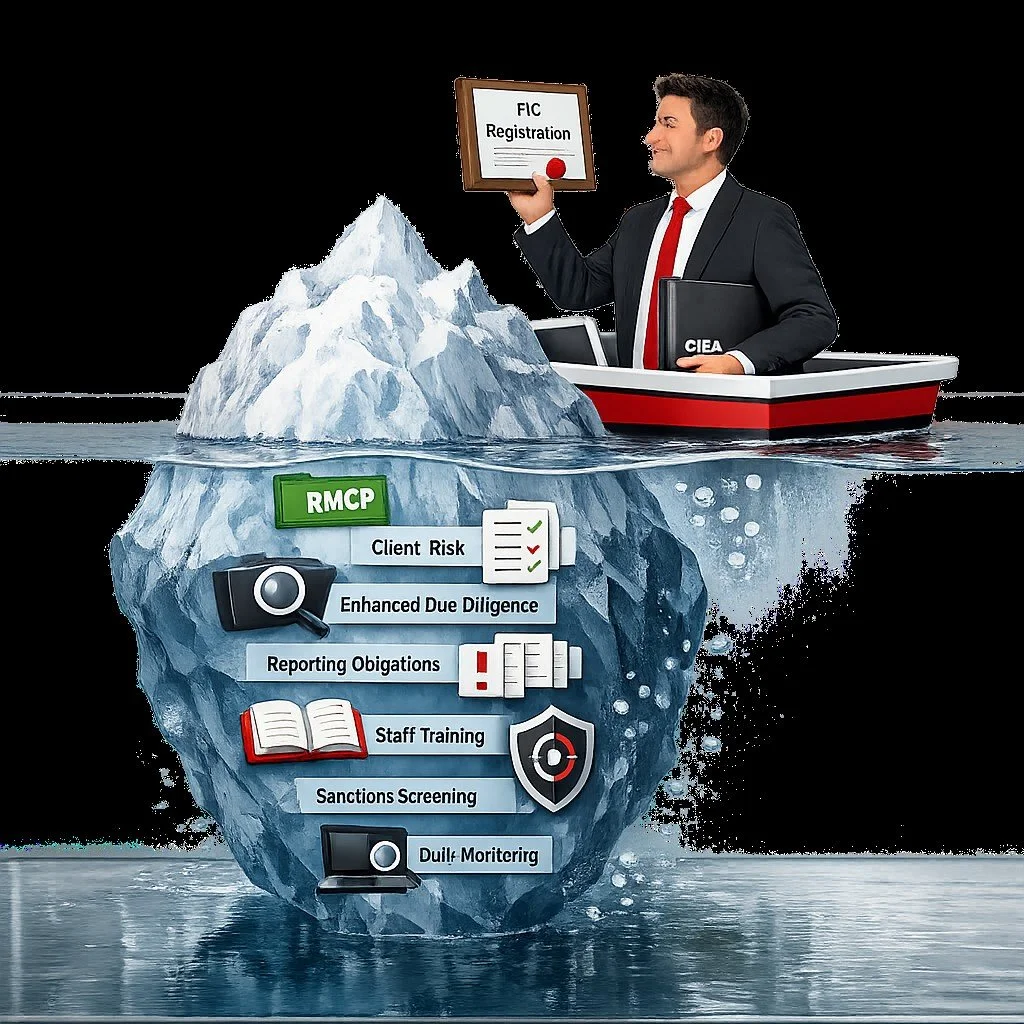

Registered with the FIC? That was the easy part. Now the real work begins. Too many firms think compliance is a once-off admin task, until an audit proves otherwise. FIC registration turns your practice into a permanently accountable institution, where every client, every transaction, and every employee decision carries regulatory risk. Here’s what every accountable institution needs to get right before the regulator comes knocking.

Suspicious Transactions: What You Don’t Report Can Hurt You

If a client’s transaction feels unusual, don’t ignore it, your career, your clients, and even your freedom could be on the line. Under the Financial Intelligence Centre Act (FIC Act), accountants have a legal duty to report suspicious activity, no matter the amount. Knowing what to look for, how to act quickly, and how to protect yourself isn’t just compliance, it’s good business.

Increased enforcement by FIC means compliance is not just a tick-box

Think FIC compliance is just admin? Think again. Audits are up, penalties are real, and ignoring the rules could cost you more than just money. But here’s the kicker, get ahead of the game and you can turn this “headache” into a high-value service your clients will actually pay for. Here's how to make FIC compliance work for your practice, not against it.