FIC Compliance After Registration - What You Should Know

Registered with the FIC? That was the easy part. Now the real work begins. Too many firms think compliance is a once-off admin task, until an audit proves otherwise. FIC registration turns your practice into a permanently accountable institution, where every client, every transaction, and every employee decision carries regulatory risk. Here’s what every accountable institution needs to get right before the regulator comes knocking.

“Delete at Your Own Risk”: The Year-End Records Mistake That Could Cost You Everything

Every December, accountants across South Africa make the same deadly mistake: we shred files we think are “old enough.” But in a world ruled by POPIA, SARS audits, seven-year rules and indefinite retention laws, one wrong destruction decision can cost you clients, credibility, up to R10 million, or even significant jail time based on the seriousness of the violation. The danger isn’t what you keep. It’s what you delete too soon. Before you touch a single box this year-end, read this. It might save your practice.

Certified Copies Aren’t Enough Anymore: What the New FIC Rules Really Mean for Your Practice

Certified copies won’t cut it anymore and neither will complacency. The FIC’s new rules have flipped client verification on its head, shifting the burden squarely onto accountants. One wrong call and it’s not your admin clerk who’s liable, it’s you. From a 66x spike in ID check costs to the death of tick-box KYC, this is the moment every small firm must decide: adapt or fall behind. The new FIC framework rewards judgment, not paperwork and it’s changing how we onboard, price, and protect our practices. Are you ready to prove you really know your client?

When Power Becomes Risk: Why Every Accountant Must Understand PEPs

That new client who “knows people in government” might be your biggest compliance risk. Under South Africa’s anti-money-laundering laws, politically exposed persons (PEPs) (and even their families) trigger the toughest checks in the book. Miss one, and your firm could face FIC sanctions that make tax penalties look like pocket change. From cabinet cousins to state-contract CFOs, the line between influence and exposure is thinner than ever. Here’s what every accountant needs to know before saying yes to a powerful client and how to keep your practice off the regulator’s radar.

Foreign Hires, Local Risks: The Compliance Rules You Can’t Afford to Miss

Foreign hires can grow your practice or expose it.

In South Africa’s post-greylist reality, hiring a foreign national isn’t just an HR step, it’s a financial crime compliance event. Every passport, visa, and background check you skip becomes a risk waiting to surface. Regulators are asking: Do you really know who’s on your payroll?

This practical guide breaks down how to protect your firm. From verification and recordkeeping to staff training and real-world risk control. Before you sign that next contract, make sure your compliance file is ready.

KYC in South Africa: Is Your Firm Sleepwalking Into FIC Trouble?

Most small firms will fail their next FIC inspection.

Not because they’re criminals, but because they’re drowning in SARS chaos, CPD confusion, and admin overload.

Here’s the harsh truth: KYC isn’t paperwork. It’s survival.

Ignore it, and you’re one inspection away from a fine big enough to kill your practice.

But here’s the kicker: the firms that get KYC right don’t just stay out of trouble, they turn compliance into a billable service their clients will pay more for.

👉 Want to know how? Read on.

Increased enforcement by FIC means compliance is not just a tick-box

Think FIC compliance is just admin? Think again. Audits are up, penalties are real, and ignoring the rules could cost you more than just money. But here’s the kicker, get ahead of the game and you can turn this “headache” into a high-value service your clients will actually pay for. Here's how to make FIC compliance work for your practice, not against it.

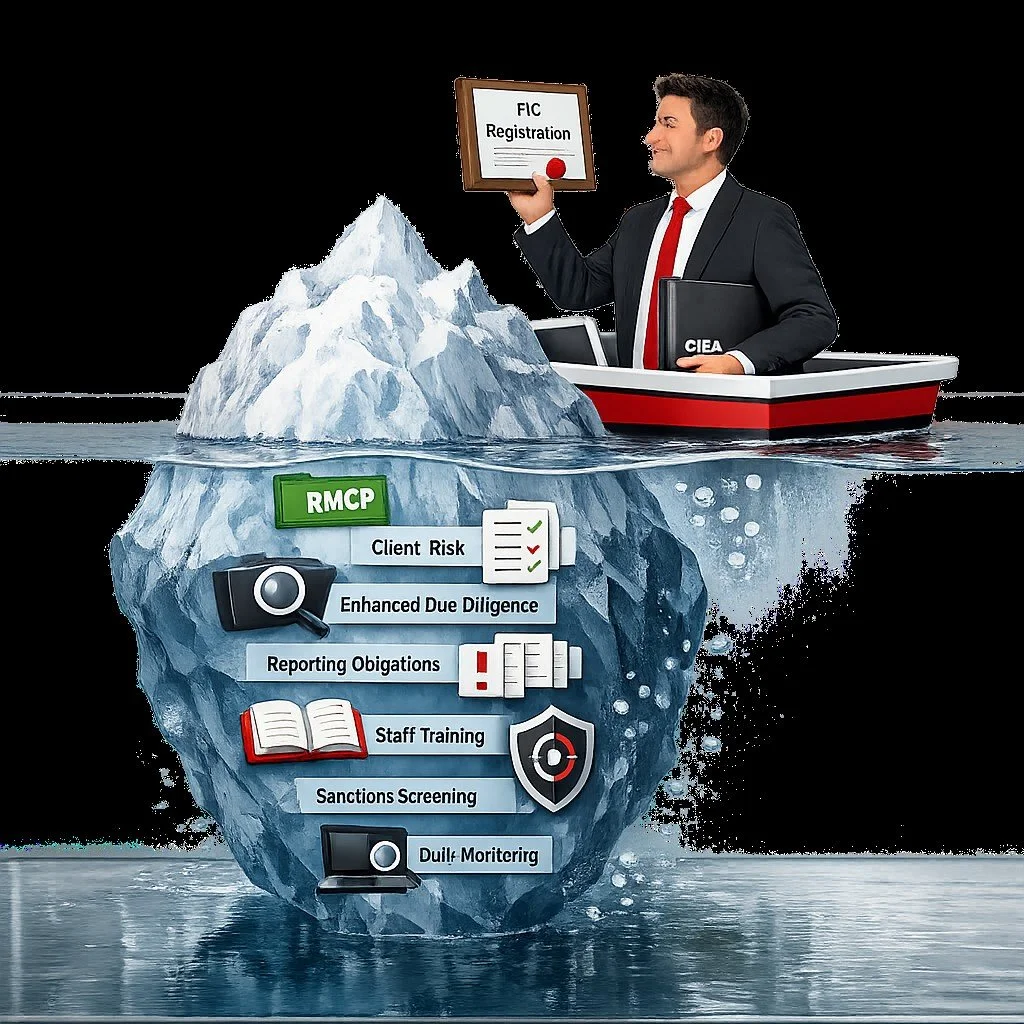

Accounting Practices as Accountable Institutions: Building an RMCP and Applying a Risk-Based Approach

When an accounting practice is registered with the Financial Intelligence Centre (FIC), it plays a crucial role in safeguarding the financial system against money laundering, terrorist financing, and other financial crimes. This article explains the responsibilities of implementing a risk based approach with practical guidance on the specific risks accountants may encounter.

Accountants as Accountable Institutions - What You Need to Know

Do accountants fall under accountable institutions? There has been much uncertainty regarding when an accounting practice must register with the FIC. At the end, if your business must register you have act now. In this article we explain the FIC’s registration and reporting requirements in a practical way.