Fibonacci Thinking in Financial Management: Can Nature’s Code Improve Your Accounting Practice?

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

What do pinecones, stock markets, and effective budget models have in common? The answer may surprise you: the Fibonacci sequence. Rooted in mathematical beauty, natural harmony and balance, Fibonacci numbers — 0, 1, 1, 2, 3, 5, 8, 13... — have guided architects, artists, and investors for centuries. But what if we applied them to accounting?

In this article, we explore how applying Fibonacci concepts can enhance financial decision-making by providing more structure, improved forecasts, and even mental clarity, offering a fresh and innovative perspective on accounting by integrating principles from nature and mathematics. The big idea? If we emulate nature’s patterns, our accounting can become smarter, more balanced, and much clearer.

What is the Fibonacci Sequence?

The Fibonacci sequence is a series of numbers where each number is the sum of the two before it: 0, 1, 1, 2, 3, 5, 8, 13, and so on. This pattern appears throughout nature—in the arrangement of leaves, pinecones, and even seashells. In simple terms, it’s a natural growth pattern that starts small and builds steadily. Due to its balance and proportion, it has been used for centuries in art, architecture, and even investing; and now, as this article shows, it has practical applications in financial management as well. Let us look at how we can apply this sequence in our everyday work.

Fibonacci Forecasting: A Layered Growth Model

In traditional budgeting, growth is often projected using a fixed linear percentage, typically assuming steady, incremental increases year after year. However, this model rarely reflects the lived experience of SMEs, whose growth is often uneven, accelerating as they gain market traction, scale operations, or introduce new offerings. A more dynamic and realistic approach is Fibonacci-layered budgeting.

This method draws inspiration from the Fibonacci sequence, where each number is built upon the sum of the two preceding it, reflecting the compounding nature of early-stage growth.

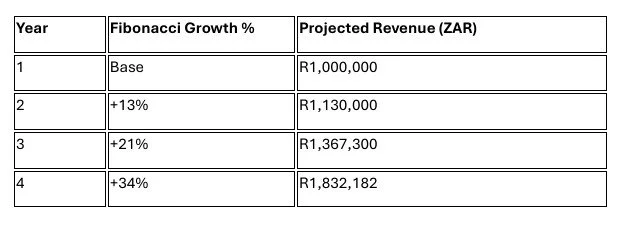

The result is a graduated scale of percentage increases that better mirrors how many SMEs expand:

SMEs can apply this model when preparing multi-year forecasts or fundraising projections, especially during early growth phases where traction, reinvestment, or new customer acquisition can lead to accelerating revenue. Rather than arbitrarily assigning fixed increases, the Fibonacci approach provides a structured, momentum-sensitive trajectory. It's especially useful when you're entering new markets, launching products, or scaling a proven service, moments when growth often leaps, not crawls.

2. Using Fibonacci in Expense Allocation

Instead of applying arbitrary percentages or flat cuts across departments, imagine assigning cost-centre budgets using a Fibonacci spread. This approach introduces a natural proportionality that aligns with strategic priorities. For example:

Admin – 3 units

Marketing – 5 units

Operations – 8 units

Product Development – 13 units

By using Fibonacci numbers (3, 5, 8, 13, 21, etc.), you establish a clear visual hierarchy that reflects strategic emphasis, allocating more to growth-driving functions like product development or operations, and less to support functions like administration. This method provides CFOs and SME leaders with a simple, logical framework for justifying allocations to boards or investors, especially when there’s a need to scale without losing financial discipline.

This model works best during budgeting cycles that follow a growth strategy, such as entering a new phase of product innovation, expanding to new regions, or ramping up marketing efforts. It’s especially useful for startups and scale-ups that need to be lean, focused, and transparent with how resources are deployed.

3. Fibonacci-Based Materiality Thresholds In Audits

In risk-based audits, applying progressive Fibonacci thresholds can sharpen the focus of audit planning by linking risk levels to proportionate audit responses. Instead of relying on fixed or arbitrary materiality limits, this method uses thresholds inspired by the Fibonacci sequence (3%, 5%, 8%, 13%, etc.) to escalate audit procedures in a structured way:

This layered approach allows auditors, especially those working with SMEs or constrained teams, to prioritise effort where the risk of misstatement increases naturally with scale or complexity. Rather than treating all areas equally or relying on overly conservative judgments, it introduces a structured, data-informed progression.

SMEs and practitioners can apply this model when scoping audits or internal reviews, particularly in situations where resources are limited and audit teams must strike a balance between depth and efficiency. It’s particularly useful for reviews performed under ISRE 2400, or in environments transitioning from informal records to more formal financial reporting.

4. Designing Financial Dashboards in the Golden Ratio

Accounting reports should be not only accurate but also intuitively usable. Applying design principles like the golden ratio (1.618:1) or Fibonacci proportions can significantly enhance the readability and impact of dashboards, reports, or management packs. For example:

Pie chart section: 62% of the screen

KPI panel: 38% of the width

Title/header: 13% of total height

These ratios aren’t just aesthetic, they guide the reader's eye, emphasize what matters, and reduce cognitive overload. This is especially valuable for non-financial managers, who may struggle with traditional layouts dense with figures and tables.

Finance teams can apply this when building internal dashboards, board packs, or monthly reports, especially when the audience includes marketing, operations, or HR stakeholders. Embedding golden ratio-based layouts in tools like Excel, Power BI, or Google Data Studio helps ensure that the most important information is seen, understood, and acted upon, without needing extra explanation.

This approach not only improves decision-making but supports auditability too: structured, well-laid-out reports make it easier to follow the financial logic, reducing review time and the risk of oversight.

CONCLUSION: IS IT WORTH THE EFFORT?

While Fibonacci is no silver bullet, it offers a fresh, intuitive lens through which to structure financial decisions. Its true value lies in its universality and mathematical coherence—providing a scalable framework that mirrors how natural systems evolve and how real businesses grow. In both nature and economics, change rarely happens in straight lines. Instead, it builds progressively, often accelerating as momentum or complexity increases. The Fibonacci sequence captures this nonlinear pattern in a way that is both logical and applicable across financial domains.

From a cognitive and behavioral standpoint, humans tend to understand and respond better to ratios and proportional relationships than to arbitrary numbers. This makes Fibonacci a practical tool for structuring information in ways that align with how we naturally perceive hierarchy, risk, and value.

Forward-thinking accountants and finance professionals can apply Fibonacci-based thinking to:

Justify budgetary allocations more transparently, especially when presenting to boards or funders.

Improve the visual logic of financial reports and dashboards, making them easier to interpret and act on.

Structure audit planning and fee models with proportionality tied to scope and complexity, enhancing both fairness and efficiency.

This approach doesn’t replace standard financial tools, it enhances them by adding layers of logic, proportion, and clarity. Whether you're advising an SME, conducting an audit, or preparing a funding forecast, Fibonacci can help simplify, visualize, and communicate decisions more effectively.