Behind the Numbers: Spotting and Stopping Financial Abuse in Business

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Introduction: The Hidden Threat in the Ledger

Financial abuse in business is a silent predator. It drains resources, erodes trust, and in many cases, devastates the organisation long before it's discovered. Unlike fraud which is usually intentional theft or manipulation for gain, financial abuse includes unethical or manipulative handling of finances sometimes within legal boundaries but with harmful intent or impact.

In South Africa, where economic pressures weigh heavily on businesses and ethical breaches are not uncommon, financial abuse can occur anywhere from large, listed companies to small NPOs. It is the responsibility of business accountants to detect the signs early and take corrective action.

Understanding Financial Abuse

Financial abuse occurs when someone manipulates financial processes, resources, or decisions for their personal benefit, at the expense of others. This can manifest as:

Misuse of company funds.

Unauthorised loans or advances.

Fictitious suppliers and employees.

Manipulating books to conceal theft.

Intimidating or controlling others to gain financial advantage.

In businesses, financial abuse not only erodes profits but also damages trust, reputation, and livelihoods. It’s more than a numbers problem it’s a governance and ethical challenge.

Red Flags of Financial Abuse

Business accountants should be on high alert for the following red flags:

1. Unexplained or Excessive Authority

An individual with excessive control over bank accounts, payroll, or procurement often without adequate oversight is a major red flag. In the VBS Mutual Bank scandal, a handful of executives manipulated internal processes with little to no checks, resulting in the looting of R2 billion.

2. Lifestyle Exceeding Known Income

When employees especially those in finance or procurement are seen living beyond their means, it may suggest misuse of company funds.

3. Lack of Transparency or Delays in Reporting

Consistently late financial reports, excuses around reconciliations, or inaccessible financial data can indicate intentional obfuscation.

4. Unusual Supplier Payments or Repeated 'Once-Off' Deals

Payments to unknown suppliers, or recurring "once-off" transactions, particularly those just below approval thresholds, may indicate manipulation.

5. Frequent Changes in Banking Details

A surge in changes to vendor or employee bank accounts without clear, verified reasons can point to redirection of funds.

6. Over-reliance on a Single Individual

If one person "knows it all" and others are sidelined from financial processes, segregation of duties is likely compromised.

Who Bears the Cost?

Ultimately, the organisation its stakeholders, employees, clients bear the cost of financial abuse. This includes:

Monetary loss: Direct theft or misallocation of funds

Reputational damage: Loss of stakeholder trust, investor pull-out

Operational disruption: Misaligned finances affecting continuity

Legal consequences: Fines, sanctions, or criminal charges

Small businesses, NPOs, and municipalities often suffer the most, lacking both the internal controls and legal muscle to recover.

Some Scandals that we have seen in the past few years

Tembisa Hospital Scandal (2022): An alleged R850 million spent through irregular contracts, many flagged by whistleblower Babita Deokaran before her tragic assassination. A lack of internal financial controls enabled the abuse.

Eastern Cape Education Department: Repeated misuse of school infrastructure funds, with tenders awarded to entities linked to officials. Lack of transparency and weak accountability structures were key enablers.

These cases illustrate that financial abuse is not confined to the private sector it thrives wherever accountability is weak, and professionals fail to act.

What Should Business Accountants Do?

As professionals entrusted with financial integrity, business accountants must go beyond balancing books they must safeguard ethical practice.

1. Implement Robust Internal Controls

Ensure segregation of duties, approval thresholds, system access controls, and regular reconciliations. Automation can help flag anomalies early.

2. Cultivate a Culture of Ethics and Transparency

Promote whistleblower protection, ethical training, and a culture where red flags are reported and addressed without fear.

3. Stay Professionally Compliant

Adhere to the CIBA Code of Ethics, ensuring independence, objectivity, and confidentiality especially when under pressure from management or boards.

4. Educate and Train

Ensure everyone in the organisation understands the importance of financial integrity and can recognise potential red flags.

5. Regularly Review and Audit Financial Processes

Frequent internal audits and random checks help detect irregularities early. Accountants must push for these even if unpopular.

6. Speak Up

In cases of suspected abuse, report to the relevant authorities such as SARS, the SIU, or the Auditor-General and inform internal governance structures.

Conclusion: The Accountant as a Custodian of Integrity

In a climate where financial misconduct can derail entire organisations and communities, business accountants are the front-line defenders. Financial abuse, once allowed to root, is costly to uproot. Prevention and early detection are not just best practices they are professional obligations. Financial abuse undermines more than just balance sheets it threatens livelihoods, trust, and societal progress. The cost is borne by everyone except the abuser.

Business accountants must be more than record-keepers; we are guardians of financial integrity. By identifying red flags early, and acting decisively, strengthening controls, and promoting a culture of transparency, we can prevent small breaches from becoming full-blown crises. You don't just protect the numbers you protect livelihoods.

As CIBA members and professionals, let’s lead with courage and integrity, ensuring that the organisations we serve remain ethical, sustainable, and resilient. We believe the modern business accountant must combine technical expertise with ethical courage.

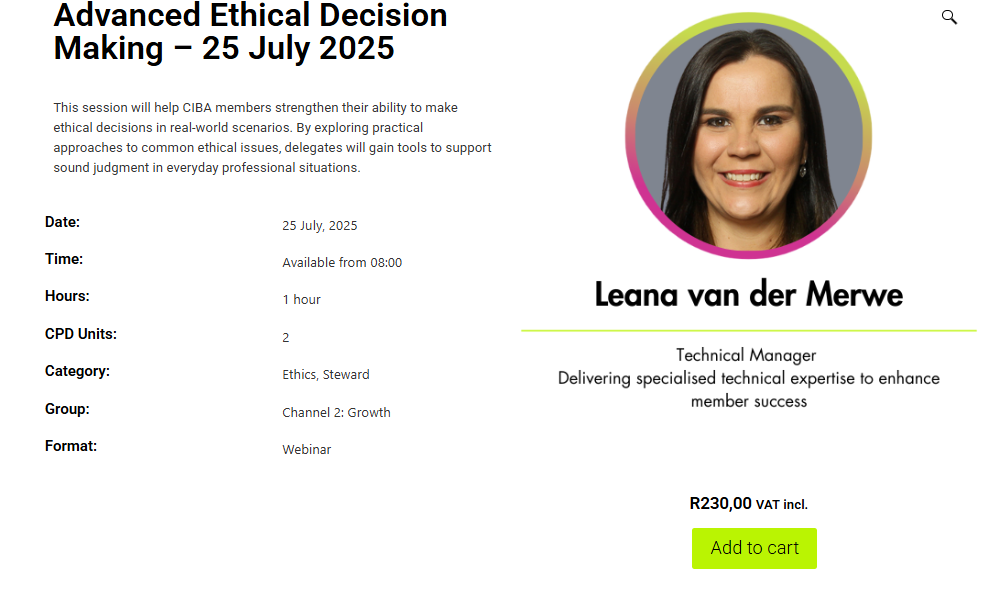

To learn more, don’t miss our ethics webinars

Click here to register

In this webinar, we’ll walk through the practical side of making tough ethical decisions in business. We’ll discuss relatable, everyday scenarios you may face in bookkeeping, financial administration, accounting, and leadership roles. This session will highlight why clear ethical standards matter and offer an easy-to-follow guide to help you make choices that stand up to scrutiny and build trust.

Presenter/s

Leana van der Merwe

Leana: Leana van der Merwe, with 18+ years in accounting and corporate governance, Leana leads technical support at CIBA and is a recognized thought leader in regulatory compliance.

What will set you apart

By attending this webinar you will gain the following competencies

Identify common ethical dilemmas specific to bookkeeping, financial administration, accounting, and management roles.

Understand the core principles of ethical decision-making and why they matter.

Apply a simple, step-by-step framework to evaluate options in tricky situations.

Recognise the impact of ethical choices on clients, companies, and personal reputation.

Communicate ethical decisions with clarity and confidence, even in high-stakes scenarios.

Event breakdown

Understanding Ethical Dilemmas

What makes a decision “ethical” or “unethical”?

Real-life examples of common ethical issues in financial work

The Decision-Making Framework

Step-by-step method to evaluate options: facts, impact, and values

How to assess long-term consequences and make choices confidently

Applying Ethics in Different Roles

Tailoring the approach for CBKs, CFAs, BAs, BAPs, CBAs, and CFOs

Hands-on scenarios that demonstrate unique challenges in each role

Open Discussion and Q&A

Encourage attendees to share experiences and ask questions

Practical advice on overcoming common obstacles to ethical decision-making

Wrap-Up and Key Takeaways

Review of the decision-making framework

Final thoughts on building an ethical reputation and fostering trust in all interactions