Joint Ventures in South Africa – What Business Accountants Need to Know

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

When clients consider collaborating on a project without forming a new company, they often explore a Joint Venture (JV). As a business accountant, you may be asked for guidance on how to set up and manage such an arrangement. This article unpacks the essentials of unincorporated joint ventures—covering agreements, accounting, VAT, B-BBEE, and tax—in clear, simple terms.

What is a Joint Venture?

A joint venture is when two or more parties team up for a specific project or business activity. It can either be:

Incorporated: The JV is registered as a company or partnership.

Unincorporated: A contractual agreement is made, but no new legal entity is created.

This article focuses on the unincorporated version—where each party remains separate but agrees to work together for mutual gain.

Why a Formal Agreement is Critical

A JV Agreement is not optional—it’s essential. This agreement should clearly state:

What the JV is about (its purpose and goals)

What each party is bringing to the table (money, equipment, people)

How profits or losses will be split

Who makes decisions and how

How long the JV will last and how it will end

Who is responsible for VAT, taxes, and compliance matters

This document may be requested by SARS, municipalities, or state-owned enterprises when applying for VAT or tenders, so keep it professional and well drafted.

Accounting for an Unincorporated JV

Even though there's no new company, accounting still needs to happen properly.

There are two common approaches:

One party is the lead: This party opens a JV bank account and keeps separate financial records for the JV (income, expenses, reporting).

Each party does their own accounting: They record their share of profits, costs, and responsibilities in their own books, based on the JV agreement.

Tip: Even if the JV isn’t registered as a company, it helps to set up a dedicated cost centre or sub-ledger to track JV activity.

VAT Registration – Yes, It’s Possible

SARS allows an unincorporated JV to register for VAT if:

The JV operates as an “association of persons”

It carries on a business activity (an enterprise)

It meets the VAT threshold (R1 million, or R50,000 for voluntary registration)

To register:

Apply in the JV’s trading name

Submit the JV agreement, ID and registration documents for all parties, proof of bank account, and address

Use the VAT101 form and tick “Joint Venture” registration

Important: Once registered, the JV must issue VAT invoices with its own VAT number. Input and output VAT should be handled through the JV VAT account, not by individual partners.

B-BBEE – What to Submit for Tenders

If your JV is bidding for public sector work, a consolidated B-BBEE scorecard or affidavit is needed.

Here’s how it works:

If the JV is 51% black-owned and the turnover is under R10 million, use a simple EME affidavit.

For bigger JVs, calculate a weighted scorecard based on the B-BBEE ratings of each partner and their share of the JV.

You will also need:

The signed JV agreement

Consolidated B-BBEE certificate or affidavit

Each partner’s B-BBEE certificate

Clear breakdown of ownership, management, and subcontracting roles

Income Tax – Who Pays?

In most cases, the JV itself does not pay tax unless it is separately registered with SARS. Each party must declare their share of income and expenses in their own tax returns.

However, if the JV is registered for VAT, it must submit its own VAT201 returns every two months.

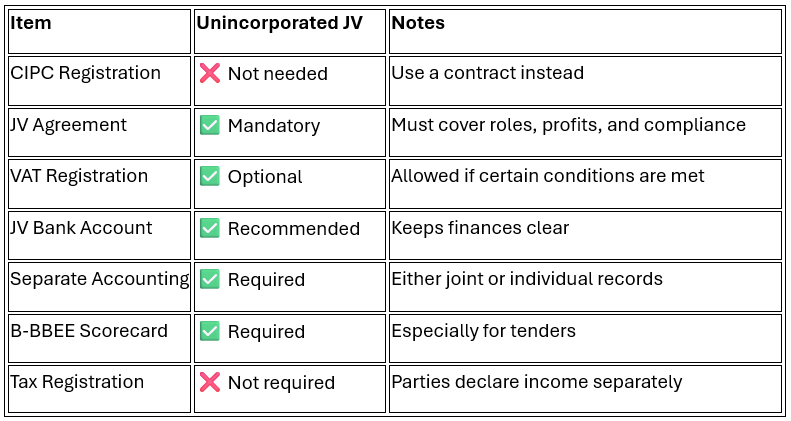

Quick Summary: Requirements at a Glance

Final Thoughts for Chartered Business Accountants

Many clients are unaware that a formal JV can exist without setting up a new company. Your role is to ensure:

The JV agreement is legally sound

Financials are cleanly separated or jointly managed

VAT and B-BBEE compliance are met, especially for tendering

Each party understands their tax obligations

Encourage your clients to speak to a tax practitioner to avoid VAT errors or disallowed input claims. And remember: even simple JV setups must follow sound accounting and compliance practices to avoid risk.

Join CIBA for a CPD on Risk Registers here

Mastering Risk: Build a Register That Actually Protects You

🗓 13 August 2025 | 🕘 09:00–12:00 | 💻 Live CPD Event | 🧠 3 CPD Units

If your risk register is a stale spreadsheet in a shared folder, it’s time to upgrade. This intermediate-level session is practical, blunt, and designed for professionals who manage real-world risk in fast-moving practices or finance departments.

💡 What you’ll learn

✔ Spot real risks—fraud, cash flow gaps, data breaches, and more

✔ Build a register that’s useful, lean, and defensible

✔ Use risk tools that actually work (and can become billable services)

✔ Keep your register alive—across SARS, CIPC, and FIC reviews

✔ Communicate risk to clients and execs in plain, chargeable language

👩💼 Presenter: Eszter Rapanos, Technical Manager at CIBA, with hands-on audit and quality control experience across firms and global organisations.

🔓 Free for CIBA Channel 2 subscribers

💰 R345 for everyone else (VAT incl.)

👉 Reserve your spot here now and turn risk management into something that actually protects—and pays.