You Can’t Run a Business Without a Proper Chart of Accounts — How to get it right

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Every invoice, every payment, every Rand that moves through a business tells a financial story.

But if your chart of accounts (COA) is a mess, that story becomes unreadable, and that’s when SARS queries, audit headaches, and bad decisions start creeping in.

Whether you’re running a private practice, managing a finance department, or advising clients, a well-designed Chart of Accounts is one of the most profitable tools you can control.

This article shows you how to build one that:

Makes you look like a pro to clients and boards

Reduces rework and audit adjustments

Supports compliance without creating admin

Turns raw data into business intelligence

What Is a Chart of Accounts (COA)?

A Chart of Accounts is the master index of every account your business uses to record transactions.

It tells your accounting system where to store every Rand so that you can easily produce:

Accurate monthly reports

Tax-ready financial statements

Cash flow insights

Management dashboards

Think of it as the Google Maps of your accounting system, if it’s badly structured, nothing flows properly.

A strong COA is not an admin document. It is the foundation of financial decision-making and accountability.

Many accountants lose hours fixing data that a proper COA would have prevented.

The Five Core Account Groups

Every Chart of Accounts must be built around five pillars:

Assets – What the company owns

Liabilities – What it owes

Equity – Owners’ interest / retained earnings

Income – Revenue streams

Expenses – Costs of operations

This structure is universal — whether you run a law firm, manufacturing plant, creative agency or audit practice.

Why a Chart of Accounts Matters for Profitability

A powerful COA delivers three strategic wins:

1.Faster, cleaner reporting

If your general ledger is inconsistent, month-end reporting becomes a forensic investigation.

A well-designed COA means:

Less time spent reclassifying expenses

No confusion around account names

Faster board packs and trial balances

2. Better insight = better advisory services

Want to sell business advisory?

You cannot provide value if transactions are dumped under “Miscellaneous” and “General Expenses”.

A clean COA lets you say:

“Your marketing spend jumped 17% this quarter while revenue stayed flat, let’s talk.”

That’s how you charge more.

3. Compliance protection

SARS and auditors love structured ledgers.

A sloppy COA = unnecessary risk and avoidable adjustments.

How to Design a Chart of Accounts That Works in the Real World

Step 1: Start with the business model

List the major revenue streams and cost drivers.

Example for a small accounting practice:

Monthly client retainers

Payroll processing fees

Statutory returns revenue (e.g., VAT, PAYE)

Outsourced CFO services

If it earns money, it gets its own line.

Step 2: Assign logical numbering

The global best practice format:

This structure keeps everything clean and software-friendly.

Step 3: Create meaningful sub-accounts

Your COA should allow you to answer questions like:

How much do we spend on salaries for billable staff vs admin staff?

What portion of revenue comes from recurring billing vs once-off projects?

Examples:

Tip: If the account name requires explanation, it needs rewriting.

Step 4: Build in future scalability

Your business will grow.

Leave account "gaps" for expansion:

Instead of:

5010 — Salaries (general)

5011 — Salaries – Business Unit A

5012 — Salaries – Business Unit B

Use:

5100 — Salaries (general)

5110 — Salaries – Business Unit A

5120 — Salaries – Business Unit B

This ensures you don’t have to restructure later.

Step 5: Document the rules

This is where most SMEs fail.

For every account, include a short description:

5300 – Legal Fees

Use this account for all external legal services, including contract drafting, litigation support, or consultations.

You avoid the #1 error in small business accounting:

Different users coding the same transaction in different places.

Real-World Examples of Great COA Design

For a Manufacturing Business

4100 — Sales: Local

4110 — Sales: Export

5100 — Raw Materials – Steel

5110 — Raw Materials – Plastics

5200 — Electricity – Production

5300 — Machine Maintenance

This lets the CFO see true production cost per unit.

For a Medical Practice

4100 — Consultations – Cash Patients

4110 — Consultations – Medical Aid

5100 — Consumables – Gloves & PPE

5200 — Medical Equipment Depreciation

5300 — Locum Fees

This supports practice profitability analysis per patient type.

Common Mistakes That Destroy Chart of Accounts Integrity

The CIBA Viewpoint: A Chart of Accounts Is a Nation-Building Tool

The CIBA Intellectual Policy Framework reminds us: Accountants are economic architects, not compliance clerks.

The systems you build determine whether businesses grow, hire people, and contribute to GDP.

A clean COA means:

Government reporting is easier

Business decisions are smarter

Financial transparency is stronger

That’s not admin. That’s economic freedom in action.

The Bottom Line

A Chart of Accounts is NOT just an internal document.

It is:

A data strategy tool

A profit driver

A compliance shield

A career differentiator

Whether you manage your own books or advise 100 clients. If you control the COA, you control the financial story. If the financial story is clear, you become indispensable.

Join CIBA here for a CPD on Building the Backbone: How to Set Up the Perfect Chart of Accounts for Every Sector

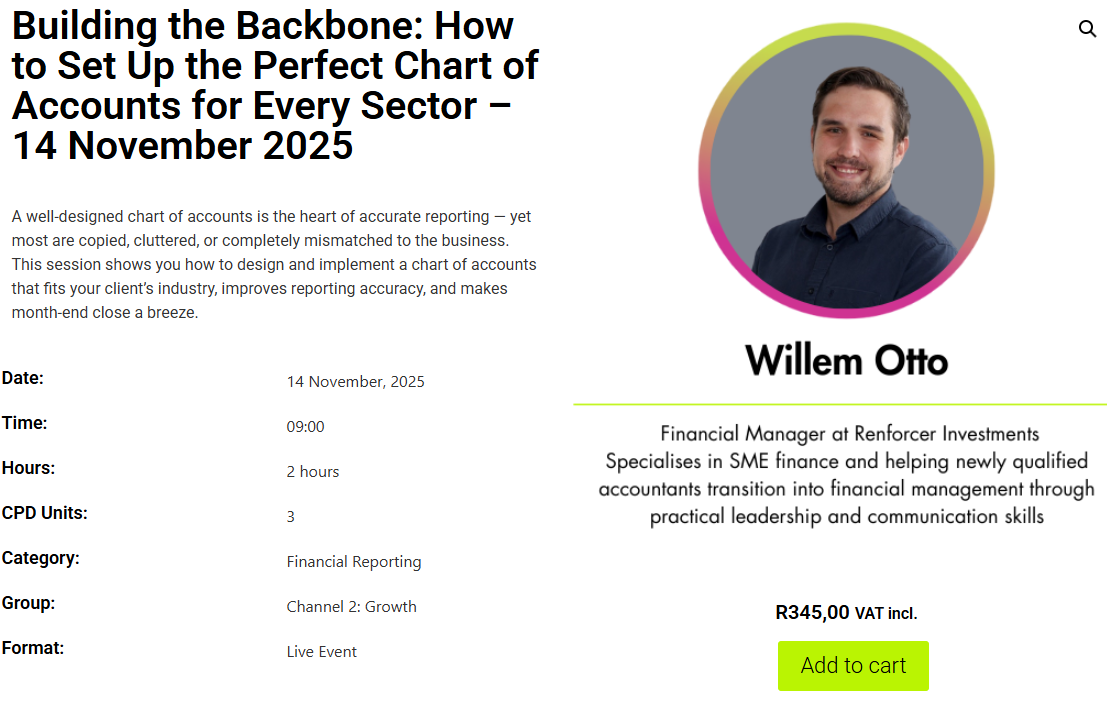

💡 Building the Backbone: How to Set Up the Perfect Chart of Accounts for Every Sector

🗓 14 November 2025 | 09:00 | 2 hours | 3 CPD Units (Financial Reporting)

A well-designed chart of accounts is the heart of accurate reporting — yet most are copied, cluttered, or completely mismatched to the business. This session shows you how to design and implement a chart of accounts that fits your client’s industry, improves reporting accuracy, and makes month-end close a breeze.

✅ Understand how different industries structure their accounts for better analysis

✅ Design a chart of accounts (COA) that supports management reporting and compliance

✅ Know which accounts to include, merge, or split for clarity and control

✅ Avoid the most common setup mistakes that cause messy financials

✅Apply sector-based examples for retail, manufacturing, construction, NPOs, and service firms

✅Create a scalable structure that supports growth, consolidation, and audit readiness

🔗 Register here

💰 R345,00 VAT incl. | Live Event | Category: Financial Reporting| Group: Channel 2: Growth

Choose Your Path to Exclusive Insights

Stay ahead in the world of accounting with premium content designed for professionals like you. Access expert articles, industry trends, and essential resources. Become a CIBA member and claim your CPD hours from CIBA.

CIBA Member Access

R250.00 FREE!

100% Discount when you become a CIBA Member. Join now to claim your CPD Hours. Register here: https://accounts.myciba.org/register