Beyond Compliance: Helping Clients Choose the Right Level of Assurance

This article will count 0.25 units (15 minutes) of unverifiable CPD. Remember to log these units under your membership profile.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Accountants don’t just crunch numbers — they help businesses make better decisions, attract funding, stay compliant, and build credibility. One of the most overlooked tools in this value offering? Choosing the right type of assurance.

Whether you’re an independent accountant preparing financial statements, or a CFO in a growing business, understanding the levels of assurance under the Companies Act can help your clients (or board) make informed choices — and avoid costly missteps.

What Is Assurance, and Why Does It Matter?

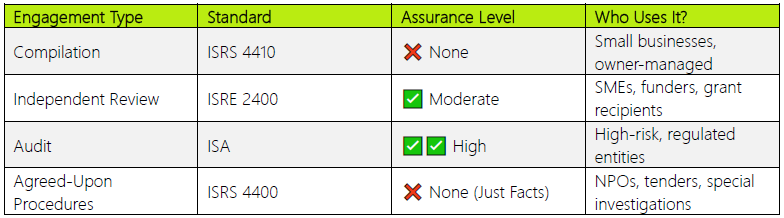

Assurance gives confidence to third parties — like SARS, investors, or lenders — that financials are accurate. But not all engagements give the same level of confidence. Here’s a quick summary:

Misunderstanding these levels leads to problems — both for accountants and their clients.

Use the Public Interest Score (PIS) as a Roadmap

The Companies Act links the assurance level to your PIS. Calculated annually, the PIS is based on:

1 point per average employee

1 point per R1 million in third-party liabilities

1 point per R1 million in turnover

1 point per shareholder

Higher scores = greater risk = stricter assurance required.

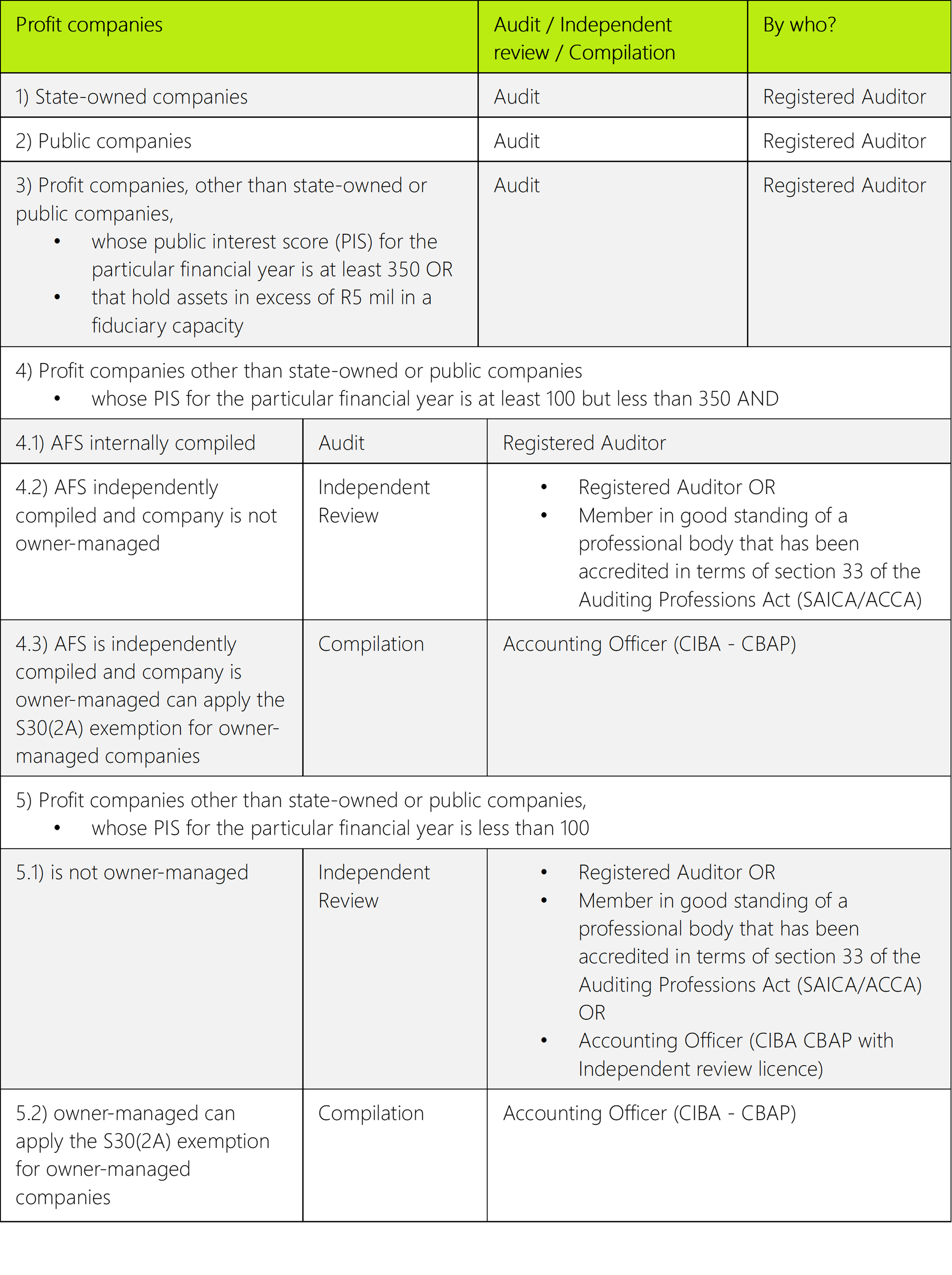

For example, a company with a PIS over 350 or holding over R5 million in fiduciary assets needs a full audit. One under 100 and owner-managed? A compilation may be enough.

When Is an Audit, Independent Review, or Compilation Necessary?

Not all companies are created equal — and neither are their reporting obligations. Whether a business needs an audit, independent review, or just a compilation depends primarily on its Public Interest Score (PIS), ownership structure, and whether its financials are internally or independently compiled. Certain company types, like state-owned or public companies, must be audited by law. Others, particularly smaller or owner-managed entities, may qualify for exemptions or lower levels of assurance. Use the following table to determine the correct engagement type based on entity type and risk exposure.

Common Mistakes That Trip Clients Up

Counting employees at group level instead of per entity

Including shareholder loans in third-party debt

Leaving out trust beneficiaries from the shareholder count

Thinking "compilation" means the numbers are verified

These errors can result in applying the wrong assurance level — or none at all when it's legally required.

What Accounting Standards Should Be Used Per Entity?

Once you've determined the correct assurance level, the next question is: which financial reporting framework applies? South African companies must follow specific accounting standards depending on their size, nature, and whether they are listed or hold assets in a fiduciary capacity. The Companies Regulations lay out these requirements clearly. Using the correct standard — whether full IFRS, IFRS for SMEs, or another approved framework — ensures compliance and credibility, especially when submitting to regulators, funders, or investors. The table below summarises which standards are required for which entities.

How Each Standard Works (and When to Use Them)

✅ ISRS 4410 (Compilation Engagements):

Prepares financials using client records

No testing, no verification

Must include a “no assurance” disclaimer

Use for small, owner-managed entities not legally required to be reviewed or audited

✅ ISRE 2400 (Independent Review):

Moderate assurance using inquiry and analytics

Cheaper and quicker than an audit

Suitable for SMEs who need confidence without the cost of an audit

✅ ISRS 4400 (Agreed-Upon Procedures):

No assurance; specific tasks agreed with client

Objective reporting of findings only

Ideal for verifying grants, compliance, or transactions without needing an audit opinion

Protecting Your Client (and Yourself)

Sometimes, accountants unintentionally give the impression that they've “checked the numbers” — especially when using phrases like “reviewed” in a compilation or forgetting to include disclaimers.

If users misinterpret your report as assurance, you could be held liable — even if that wasn’t your intention.

Avoid this by:

Using proper engagement letters

Staying within the scope of the applicable standard

Keeping services clearly separated

Being transparent with clients about what the engagement does and doesn’t cover

Turning Assurance Into a Value-Add

Assurance isn’t just a legal requirement — it’s a trust tool. When offered correctly, it:

Builds credibility with banks and funders

Protects directors from future disputes

Helps NPOs meet donor requirements

Uncovers issues before they become problems

As an accountant, you can help clients choose the right level for their situation and then position it as a billable, strategic service — not a grudge purchase. To offer this additional review services to your clients complete the CIBA Independent Review License.

Final Thought: Help Clients Navigate the Grey Areas

When clients say, “I just need financials done,” what they often mean is: “I need someone to help me avoid risk.” By helping them select the right assurance level — and doing it transparently — you become more than a compliance partner. You become a trusted advisor.

Join CIBA for a CPD on Assurance Levels That Keep You (and Your Clients) Out of Trouble here

Choose Your Path to Exclusive Insights

Stay ahead in the world of accounting with premium content designed for professionals like you. Access expert articles, industry trends, and essential resources. Become a CIBA member and claim your CPD hours from CIBA.

CIBA Member Access

R250.00 FREE!

100% Discount when you become a CIBA Member. Join now to claim your CPD Hours. Register here: https://accounts.myciba.org/register